Gone are the days when you would have to sift through stuff multiple cardboard files or plastic folders to keep a track of your investments and expenses. Smartphones have made our lives easier with dozens of apps available online that promise to make you rich. Metaphorically, we mean. Now, you can track your spend, scan and pay, invest and keep your money safe. However, how do you decide which ones to use?

Breathe! We have analysed each of these apps in terms of their authenticity, reliability, ease of use and security. When it comes to financial apps, security is the crux. So go ahead and pick one, and then let the app work for you!

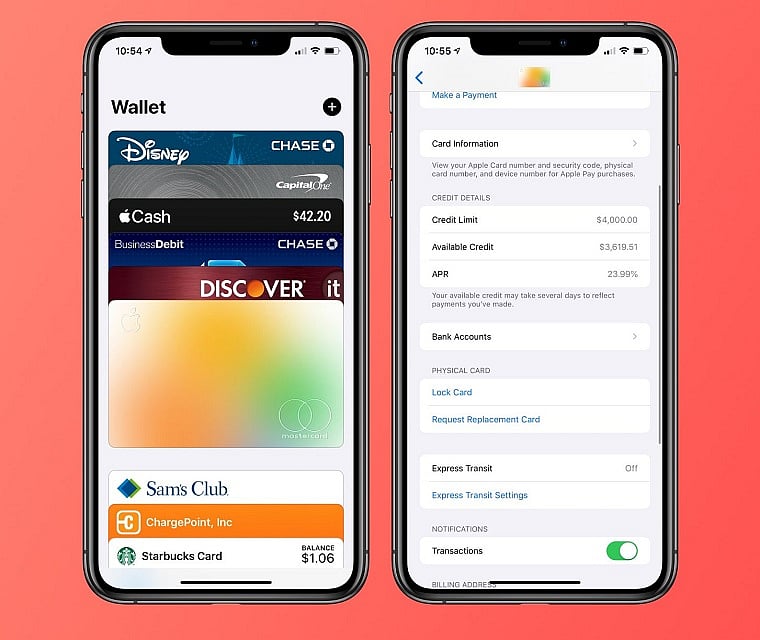

Wallet

Chuck your notebooks as well as spreadsheets and budget for clear, tangible goals that are easy to track in real time. It may be for your holiday travel, education, family, car expenses, small business expenses or any other costs you may have. Wallet by BudgetBakers is not just a finance expense tracker, report or budgeting app. It’s all about getting things under control now, so that you can make wise decisions and plan for the future - a month, a year or 10 years down the line. You can easily control your spending and save more using a finance tracker.

Platforms: iOS and Android.

Free or Paid: In-app purchases

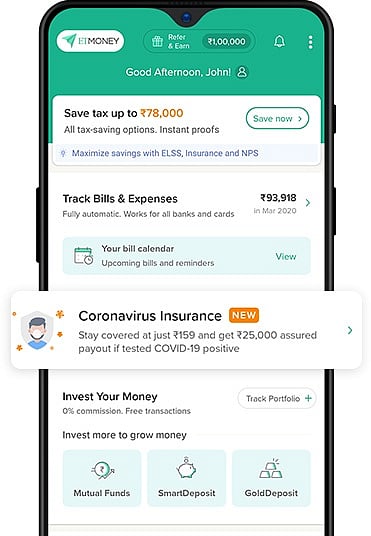

ET Money

Let’s talk about investment. ET Money is a one-stop destination on your smartphone to save taxes by investing, mutual funds or NBFC Fixed Deposits. The best part about ET Money is that it doesn’t charge you for your mutual fund investment, unlike your agents. Plus, its insightful analysis helps you choose the right funds. While local agents usually have an eye out for commissions and offer barely five to eight funds, ET Money offers you a choice of over 50 funds, ranging from bluechip, midcap to the ones investing in China, NASDAQ, etc.

Additionally, the app helps you keep track of your expenses, by collating them from your bank’s text messages.

Platforms: iOS and Android

Free or Paid: Free

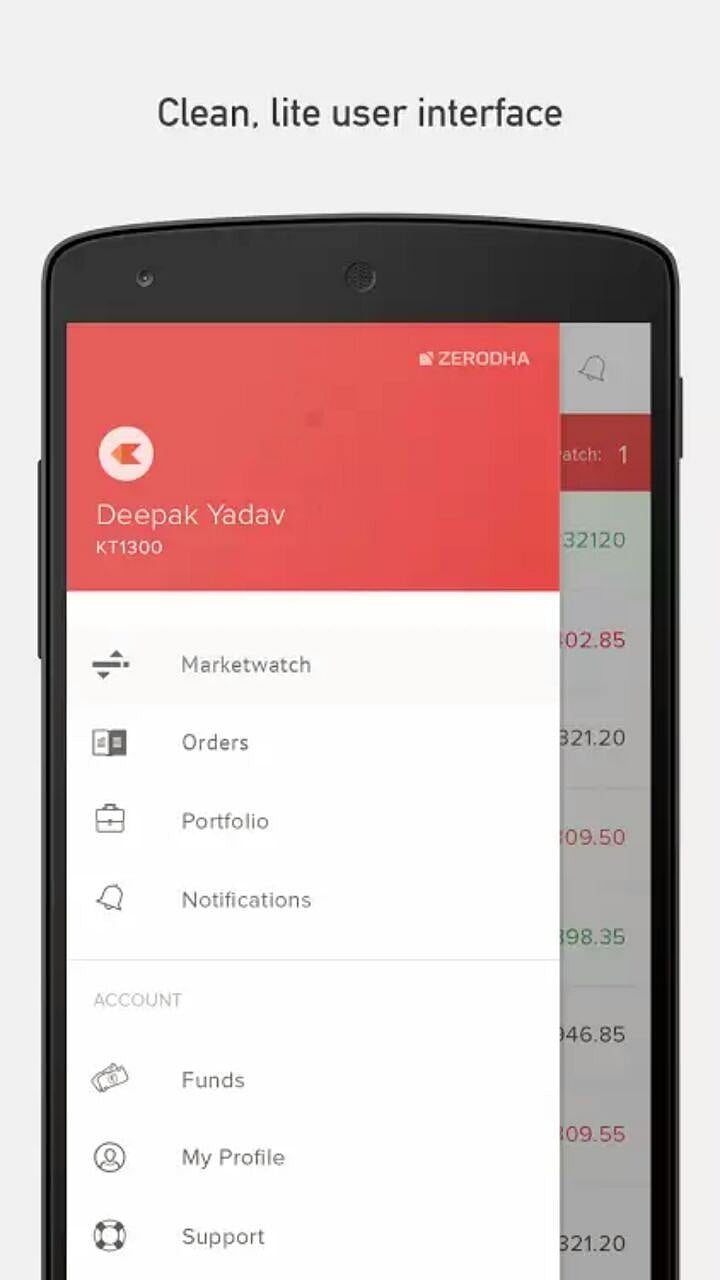

Kite

If you are looking to start investing in the stock market, this is the best app for you. Zerodha's flagship trading platform Kite comes with a clean and intuitive UI and a super-fast and super light back-end for all your trading needs. Unlike other platforms, Kite charges zero brokerage for investments and flat Rs 20 for F&O trading.

Plus there’s a specialised GTT – Good Till Triggered feature. You can place single-leg triggers to enter or exit stock holdings until your price condition is met, along with simultaneously placing target and stop-loss (OCO or One Cancels Other) for your stocks.

Platforms: iOS and Android.

Free or Paid: Rs 300+GST (annual)

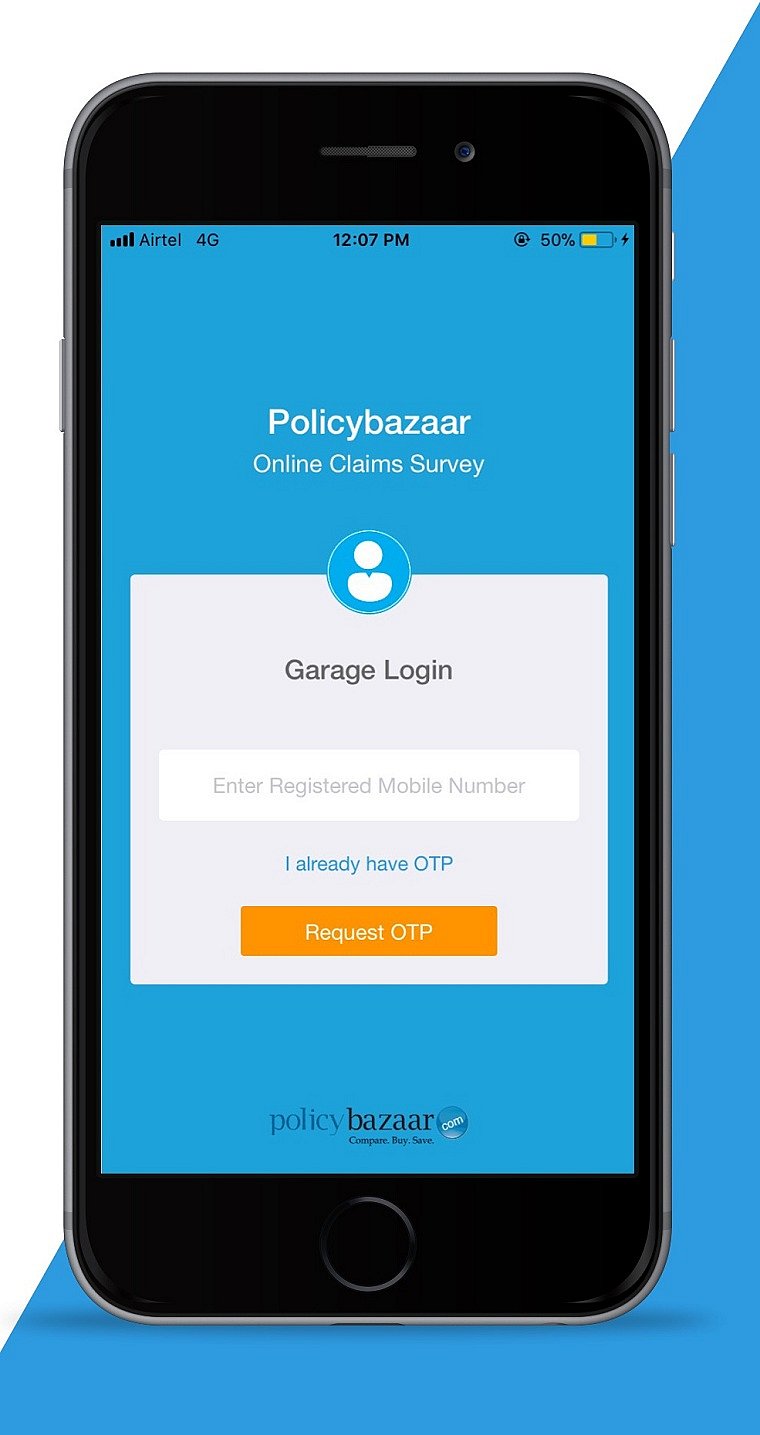

Policybazaar

Well, while most people treat this app as a simple insurance platform, it is actually quite good for investments. If you have just embarked upon your career, you have multiple goals ahead of you. The good thing about this app is, unlike insurance agents, you can scroll through multiple policies. And you will actually discover certain policies you never knew existed! You can also compare policies of various brands. However, the cons of this app are regular spam calls and certain limitations as compared to a direct purchase.

It’s advisable to explore, compare the insurance offered, and then go to the company’s website to make an informed decision.

Platforms: iOS and Android

Free or Paid: Free to use

.jpg)

.jpg)