Over the last few years the number of families with a family member living abroad has gone up significantly. For example, in our colony at least one member from every household is staying overseas. The children either go overseas for study and then end up settling abroad or they are deputed by one of the Information Technology companies on a long-term onsite assignment. As a result, the WhatsApp calls play a key role in helping bridge this gap. Another route playing an important role in keeping the long distance relationship going are the social media posts on Facebook. Net result, it is easy for anyone to get access to where a person is presently located, his current status,his close relations, his friends circle etc. Similarly through social media posts it is also easy to get access to the voice clips. With the rapid development of Artificial Intelligence (AI) in technology, it has become easy for fraudsters to clone any person’s voice and set up a script that can be delivered in that individual’s voice. This has left everyone vulnerable to voice cloning frauds.

Artificial intelligence (AI) is fueling a rise in online voice scams, with just three seconds of audio required to clone a person’s voice. A new survey, ‘The Artificial Imposter’, was conducted by McAfee with 7,054 people from seven countries, including India. The study shows that 69 per cent of

Indians are not confident that they could identify the cloned version of a voice from the real one, with 47 per cent Indian adults having experienced or know someone who has experienced some kind of AI voice scam. The cost of falling for an AI voice scam can be significant, with 48 per cent Indians losing over Rs 50,000.

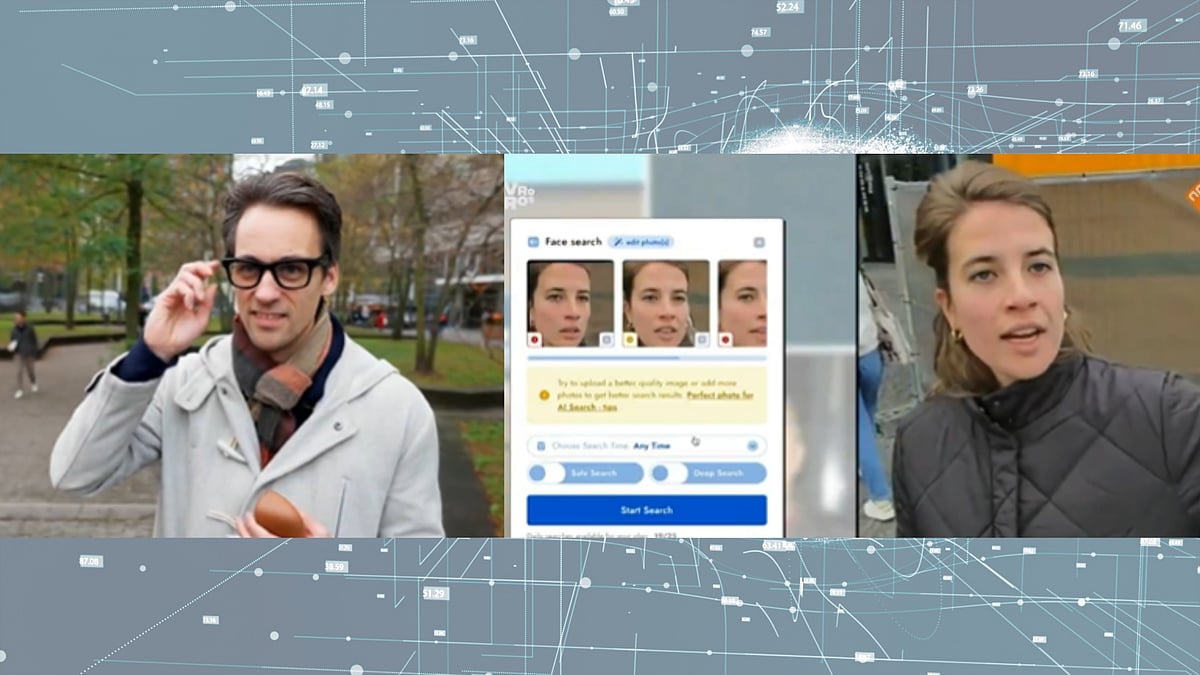

The researchers at McAfee also found more than a dozen AI voice-cloning tools that were freely available on the internet. Some devices require only a basic level of experience and expertise, with just three seconds of audio enough to produce an 85 per cent match. By training the data models, McAfee researchers achieved a 95 per cent voice match based on just a small number of video files.

The modus operandi

A common modus operandi involves a distress call from someone trusted probably from your own contact list. The fraudsters hack your phone and get access to your contact list. Then search for the names from your contact list on social media. Look to download a post with a voice clip. The voice clip is used to simulate a distress call from someone you know — son, daughter, friend, superior from your workplace — seeking urgent assistance with a promise to return the favour. The situation simulated is either a lost wallet at the airport or an accident requiring urgent money to be transferred for emergency medical assistance.

As per the McAfee report most people would respond to the call if the request had come in from their parent (46%), partner or spouse (34%), or child (12%). Respondents were also more likely to answer if the scammers claimed that the sender had been robbed (70%), was involved in a car accident (69%), lost their phone or wallet (65%), or needed help while travelling abroad (62%).

The dos and don’ts

Recently the WhatsApp calls from international unknown numbers have been on the rise.

The dos

Cross check by directly calling your contact to verify the authenticity of the “emergency”

Limit your digital footprint of personal information via posts on your social media accounts which a criminal can use to create a situational compelling narrative

Verify the caller, use a codeword, or ask a question only they would know.

The don’ts

Don’t make your social media account public. Given the access to sensitive information uploaded on social media, it becomes essential to restrict access to only people from your contact list

Don’t believe voice messages either received via SMS or posted on WhatsApp via unknown numbers.

Think twice and be careful before you act on any voice messages or calls from unknown numbers. See you soon with the next article in this Jankar Baniye series.

(Salil Datar is a senior banking and finance professional and has more than three decades of experience in banking, neobanking and cross border financial services)