A 60-year-old retired engineer from Kamaothe lost Rs1.8 crore to cyber fraudsters on the pretext of buying a new insurance policy with better returns.

The complainant received a call in 2020 from a woman who identified herself as the manager of the insurance company from where the complainant had bought the policy in 2014. The woman told him that he would get only 30% on maturity while 70% would go to the agent. She also provided a couple of mobile numbers to lodge a complaint at the Lokayukta regarding the problem.

Complainant bought more policies after being promised higher returns

However, the complainant called those numbers and was urged to buy more policies to get the full amount on maturity. They also provided certain other mobile numbers to buy policies online. As suggested, he bought the policy but other fraudsters posing as senior officials kept promising higher returns, inducing him to pay Rs1.8 crore.

At one point in time, they assured up to Rs5.8 crore return and they also sent a PDF of the cheque in the email, assuring him that the payment was under process. According to the complainant, they also took money in the name of investing in an initial public offering. They sent fake certificates of insurance papers. When the complainant expressed his wish to meet them, they gave strange reasons and avoided it.

The Kamothe police have registered a case against nine persons under the relevant sections of the Indian Penal Code.

Mumbai Police cyber cell cautions public

According to Cyber Crime Cell under Crime Branch of mumbai police , the most common form of online frauds are related to banks, online commerce platforms where fraudsters, posing as bank /platform officials, convince the victim to share OTP, KYC updates and sometimes send the links to be clicked to access bank accounts.

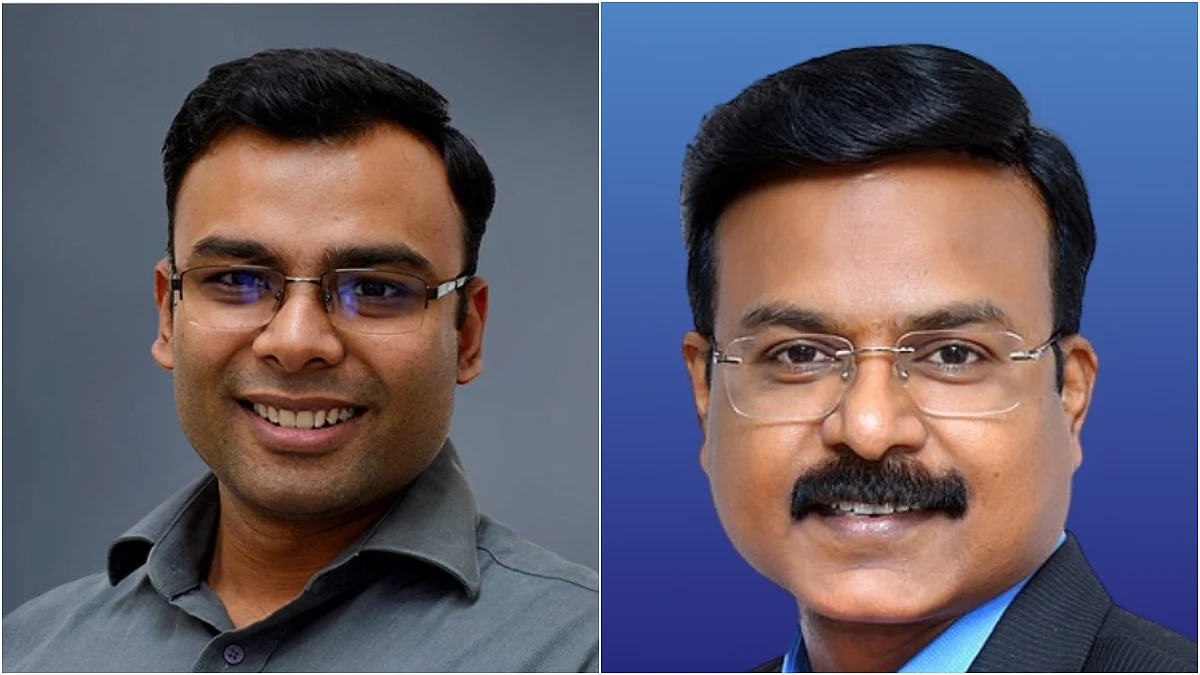

“People should know that no bank or institution is authorised to demand for bank details or PIN numbers. Unfortunately, educated people are falling prey to online frauds and losing lakhs of rupees,” explained DCP Cyber Crime , Balsingh Rajput

10 Tips to avoid online banking fraud | FPJ