As a traditional savings option, fixed deposit is one of the safest investment options for you to grow your savings. Among different options available in the market, Bajaj Finance Fixed Deposit is one of the most preferred. Read on to know what makes Bajaj Finance FD a better option than other investment options available.

Highest safety of deposit

Investing in market-linked instruments during times of market volatilities can come with risks of declining portfolio value, lower returns and principal depreciation. Thus, to protect your savings from market risks, consider investing in a fixed deposit, so your returns are not affected by market fluctuations or changing economic dynamics.

During these uncertain times, it is necessary to look for investments that guarantee security. Bajaj Finance FD is accredited with the highest safety ratings of FAAA (stable) by CRISIL and MAAA (stable) by ICRA, which indicates highest safety of your deposit.

Additionally, with a deposit book of more than Rs. 24,000 crore, Bajaj Finance upholds the trust of more than 2,50,000 happy FD customers.

Attractive FD interest rates

At a time where retain inflation is reaching 5%, average interest rates offered on FD range from 3-5%, which is very low. During these challenging times, Bajaj Finance offers attractive FD rates up to 7% to individuals below 60 investing via offline mediums.

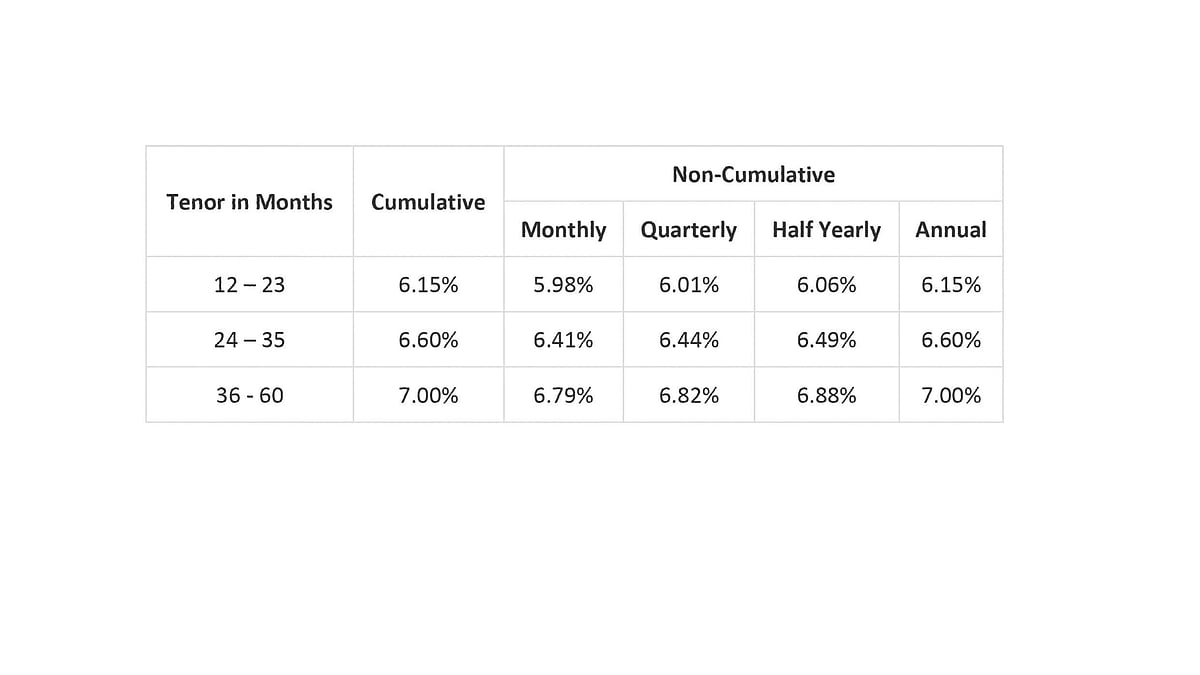

Here’s a look at these latest fixed deposit rates for non-senior citizens investing offline.

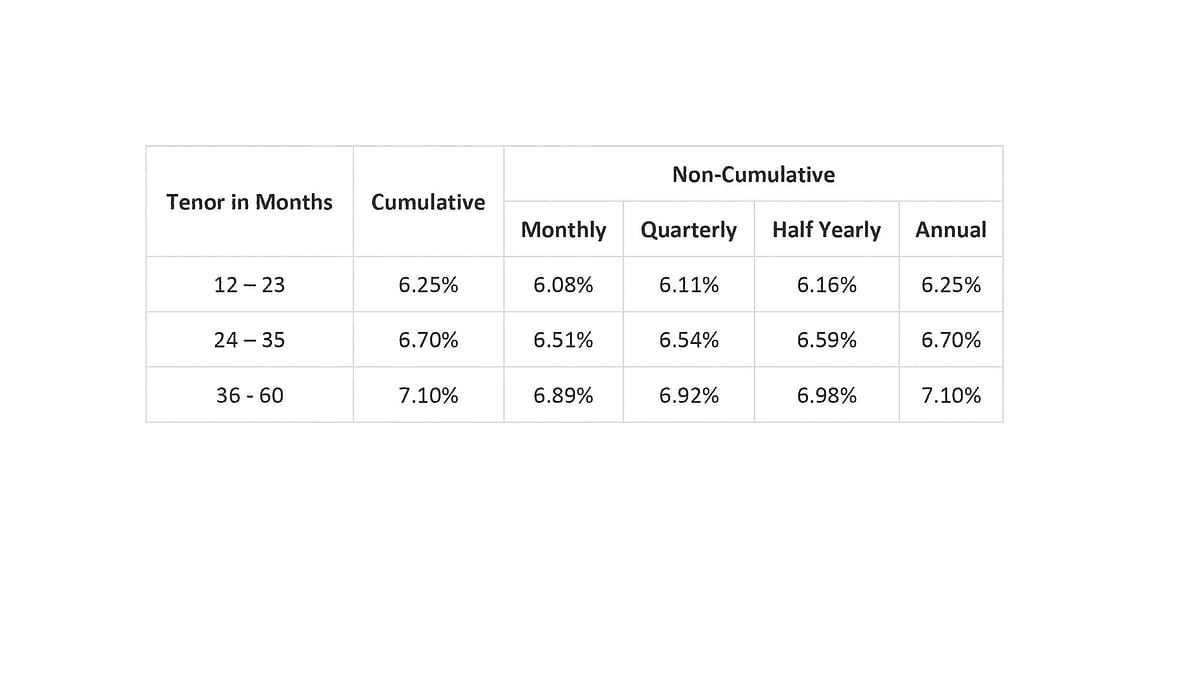

For non-senior citizens choosing to invest online through the Bajaj Finserv website, there is an additional rate benefit of 0.10%. Here are the latest FD interest rates for non-senior citizens investing online.

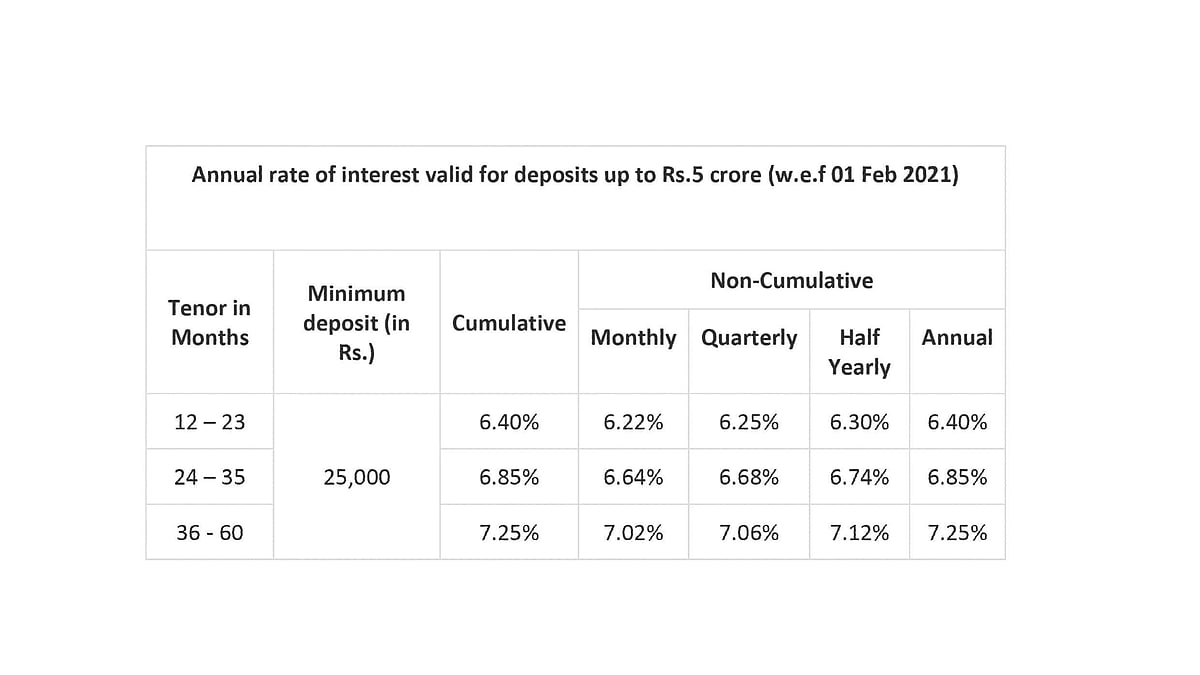

Additionally, senior citizens get a rate benefit of 0.25%, regardless of the mode of investment they choose. Here’s a look at the latest FD interest rates offered to senior citizens investing in a Bajaj Finance Fixed Deposit.

Thus, for those looking to grow their savings at assured returns, Bajaj Finance FD can be the best investment option. You can also use the FD interest calculator to know your returns beforehand, so you can plan your investments better.

Flexible and convenient options

When investing in a Bajaj Finance FD, choose tenors ranging from 12 to 60 months, as per your convenience. You can also choose the frequency of payouts, as per your convenience. If you’re looking at higher growth of corpus, choose to receive payouts at maturity. On the other hand, if you’re looking for periodic income to fund recurring expenses, consider receiving payouts at periodic intervals. You can choose frequency of payouts on a monthly, quarterly, half-yearly and annual basis.

Investing in a Bajaj Finance FD requires an investment amount of just Rs. 25,000. However, those who are unable to raise a lumpsum amount to start investing, can choose to save on a monthly basis with Systematic Deposit Plan. Here, you can make monthly contributions starting just Rs. 5000 per month. Thus, this option offers the flexibility to invest on a monthly basis, with the assurance of guaranteed returns – offering the perfect blend of safety and convenience.

Easy online investment process

In comparison with other investment instruments, Bajaj Finance offers higher investment convenience and flexibility. You can invest in a Bajaj Finance online FD from the comfort of your home, without having to face the trouble of visiting a physical branch or processing lengthy paperwork. Simply enter your intended investment details, verify your documents online and pay via Net Banking or UPI (for amounts less than Rs. 1,00,000).

Locking into the best FD interest rates offered by Bajaj Finance will take you less than 10 minutes. What’s more – non-senior citizens get an additional rate benefit of 0.10% by investing online.

When compared to fixed-income investment avenues like PPFs or government savings schemes, Bajaj Finance FD has a shorter lock-in period of just 3 months. You can access your savings at anytime, and also avail a Loan against FD facility to fund emergencies.

As compared to market-linked instruments, Bajaj Finance offers a combination of safety and attractive returns for you to grow your savings without any worry. Make a smart investment option with Bajaj Finance and grow your savings easily.