India’s largest spirits maker United Spirits’ (USL) last quarter performance was much below the street estimates. The sharp dip in Profit was due to lower other income (down 65%) and higher taxes (up 120%), partially on earlier years. Prestige & The Above segment was disproportionately impacted by the closure of the on-premise channel. The premium segment volume fell 19.6% on a yearly basis.

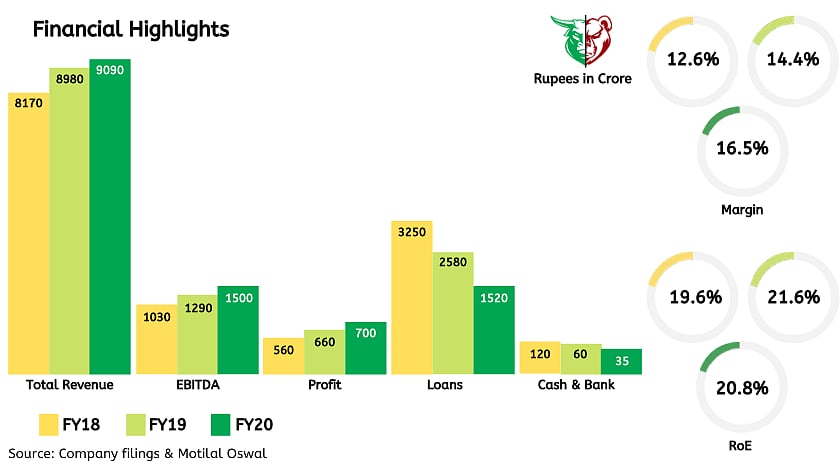

Fiancial Highlights | Teji Mandi

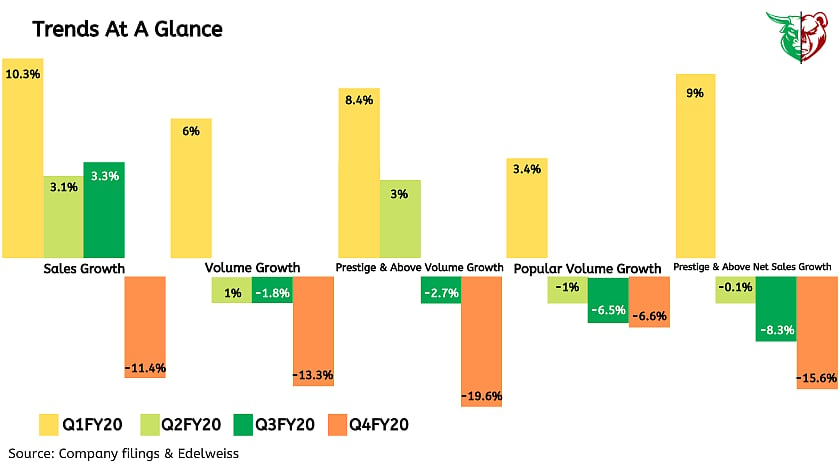

COVID-19 adversely impacted volumes and thus hurting sales

Overall volumes plunged 13.3% since last year on a base of 1%, clearly reflecting the impact of the disruption caused by the Coronavirus outbreak. The popular segment’s volume declined 7.5% on a base -4.5%. High input costs, especially the Extra Neutral Alcohol (ENA) which is the primary raw material for making alcoholic beverages and the dilutive impact of the last tranche of bulk scotch sales led to 433bps fall in the gross margin which was at a 16-quarter low.

Trends at a Glance | Teji Mandi

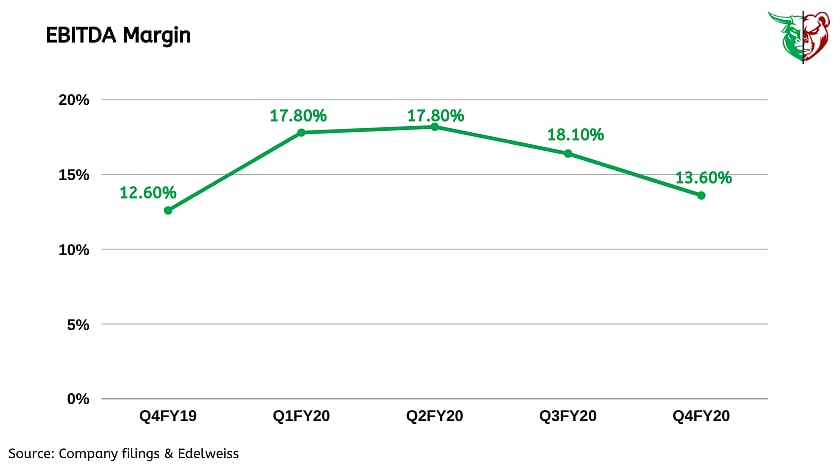

Aggressive cost control saved EBITDA margins

High input costs impacted the gross margins. However, the company managed to maintain its EBITDA margin with the help of aggressive cost reductions in marketing and other overheads.

EBITDA Margin | Teji Mandi

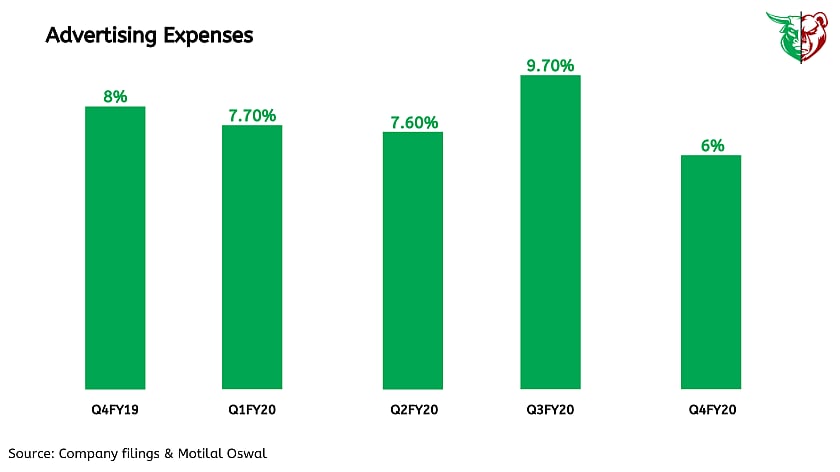

Focus on managing costs in Financial Year 2021

Given the exceptional nature of Financial Year 2021, management is revisiting all costs including marketing. The company has been able to drive strong cost reduction in the past 3-4 years which has reshaped the Profit and Loss statement. Lower input costs and ethanol prices could be a tailwind for gross margins. Therefore EBITDA margin is likely to expand despite the revenue decline and weaker product mix.

Advertising Expenses | Teji Mandi

Relaunch of McDowells No1 and Royal Challenge has seen positive feedback

United Spirits has relaunched two of its largest Prestige brands McDowells No1 and Royal Challenge in the past few months. The initial feedback has been positive.

Opening up home delivery and online ordering a significant long-term positive

One of the positives coming out of COVID-19 is that many states have opened up home delivery of spirits and online ordering of spirits. This is a big long-term positive. There are only ~70,000 liquor shops in India compared to ~10 million grocery shops, and distribution has been a bottleneck for growth. Online ordering can eliminate this bottleneck.

Downward factor

High tax increase

Hit to on-premises sale

General economic slowdown

Teji or Mandi?

While sales were impacted by COVID related disruption, the margin performance was healthy. In the last few quarters, a sharp focus on cost optimization has led to robust margin performance and in the near term, while sales growth will be challenging for the industry and the company, operating performance should be better, supported by relatively benign COGS environment and cost optimization measures.

Thus our take is Teji for United Spirits as it remains the best play on India’s liquor industry (in the listed space) by robust market share and benefits ensuing from management control of Diageo.

Teji Mandi is a proactive investment manager for everyone. To read more of our research, please visit https://tejimandi.com/research