Tata Steel reported healthy operational numbers IN Q4 wherein EBITDA came in higher than the street estimates. European operations surprised positively by reporting positive EBITDA/tonne. However, the bottom line was impacted by exceptional expenses that led to a net loss for the quarter. Standalone operations reported a sales volume of ~3.0 million tonnes (MT), which was marginally lower while European operations reported steel sales of 2.4 MT, higher than the estimate of 2.3 MT.

Teji Mandi

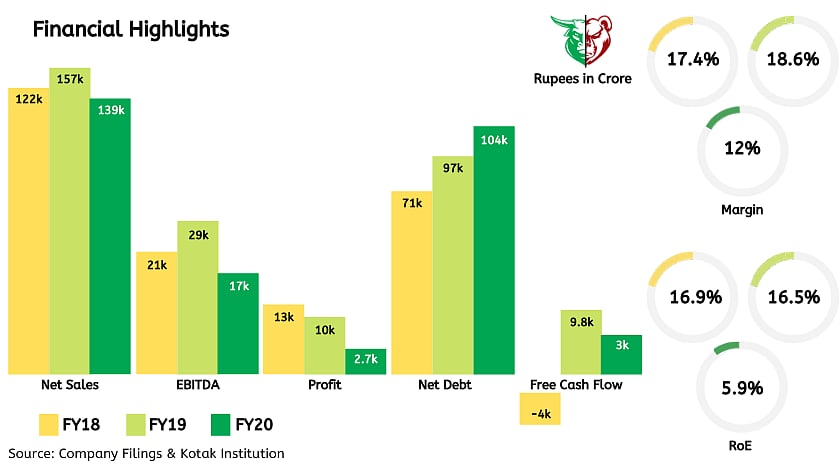

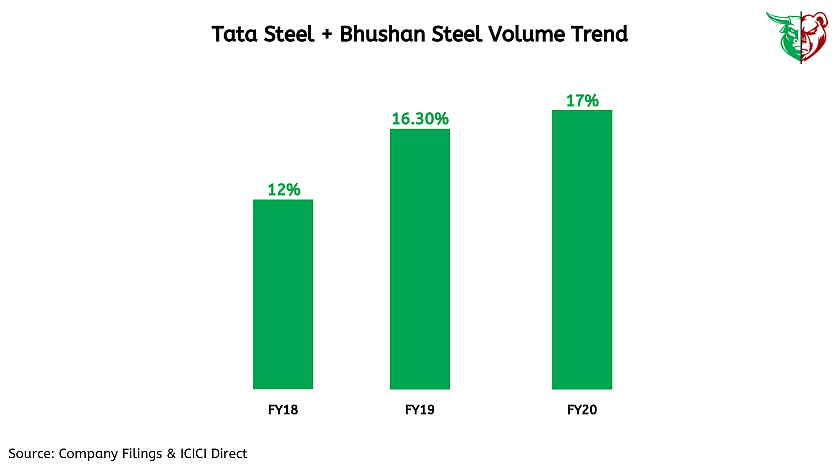

Domestic operation in Financial Year 2020 comprises 64% of total sales volume

In India, Tata Steel has operations in Jamshedpur (10 MT), Kalinganagar (3 MT), Tata Steel BSL (5.6 MT), and Tata Long products (1 MT), aggregating to 19.6 MT. Indian operations’ key assets viz. Jamshedpur, Kalinganagar, Angul have a globally cost-competitive position, aiding overall EBITDA margins. In Financial Year 2020, the higher-margin domestic operations accounted for ~64% of overall sales volumes. During the year, Tata Steel’s consolidated sales volume was 26.7 MT of which Indian operations contributed 16.97 MT as compared to ~57% in the last Financial Year 2019.

Teji Mandi

Capex curtailed on account of the uncertain business environment

Given the uncertain business environment, CAPEX is being curtailed sharply and restricted to safety and sustenance projects. The CAPEX plans will be revisited in the 2nd half of the Financial Year 2021 or when business conditions normalize. The company guided that it shall prioritize the commissioning of the pellet plant, CRM mill complex, and take up further CAPEX for KPO2 expansion as per market conditions. Total CAPEX guidance stands at Rs 5,000 crore for Financial Year 2021 at the consolidated level with ~50:50 split between India: Europe.

Teji Mandi

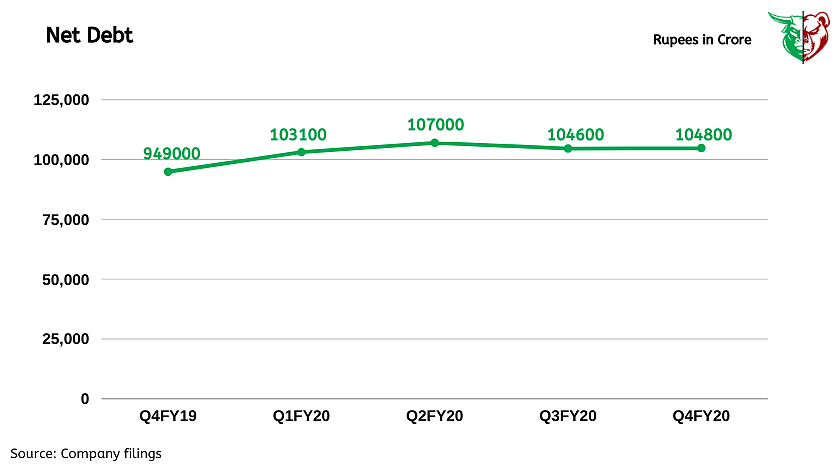

Net debt remained stable since quarterly

Tata Steel’s consolidated net-debt increased marginally to Rs1,04,800 crore in March 2020 from Rs 1,04,600 crore in December 2019.

Tata Steel Europe Operation

Revenue decreased to Rs 55,939 crore in Financial Year 2020 primarily due to a sharp decline in European steel prices and lower deliveries, resulting in loss of Rs 664 crore at the EBITDA level. In the last quarter, revenues declined by 2% to Rs 13,588 crore while EBITDA improved to Rs 65 crore compared to an EBITDA loss of Rs 956 crore in the third quarter of Financial Year 2020.

The demand outlook for Steel

Steel demand is recovering gradually with phased relaxations in mobility restrictions aided by normal monsoon and pent-up demand. In Europe, steel demand has been adversely affected; while the automotive sector continues to struggle, demand from packaging is strong. Volumes got severely impacted due to lockdown in the last week of March which is usually the peak demand period for the company. Sales were next to nil in April, while they picked up in May and June and the company is currently operating at 70% capacity and expects to ramp up as demand picks up.

From management's desk

Financial Year 2020 has been a challenging year. The Indian economy slowed down in the first half with key steel-consuming sectors like automotive contracting sharply. While the economy began recovering in the second half, the outbreak of Covid-19 in end March led to unprecedented disruption and heightened economic uncertainty.

While deliveries in India were marred by the nationwide lockdown in late March 2020, margins improved on the back of stronger performance in the early part of the quarter. Both the acquisitions, Tata Steel Bhushan Steel and Tata Steel Long Products continue to deliver improvements in operating KPIs which has translated into better profitability. Tata Steel

Europe showed a turnaround in performance with positive EBITDA for the quarter.

With a sharp fall in volumes in the first quarter of Financial Year 2021, the company is witnessing early signs of recovery and remains poised to leverage our position on the normalisation of business conditions.

Downward factor

Fall in global steel prices and spreads

Higher global coking coal prices

Sustained weakness in domestic auto demand

Overcapacity in China

Teji or Mandi?

In April 2020, Tata Steel’s Indian operations operated at ~50% capacity utilisation. With the phased removal of lockdown restrictions in India, Tata Steel’s upstream steelmaking operations have been ramped up and are currently operating at about 70% utilisation levels. Downstream units have reopened and are steadily ramping up. In Europe, Tata Steel Europe continues to operate at about 70% utilisation.

Thus our take is Teji as after a muted 1st quarter performance in the Financial Year 2021 because of COVID-19, the management expects to return to normal capacity utilisation levels by the 2nd quarter.

Teji Mandi is a proactive investment manager for everyone. To read more of our research, please visit https://tejimandi.com/research