In this edition of Annual Report Insights, we analyse Nestle India’s (Nestle) Calendar Year 2019 annual report. We conclude that the company under Suresh Narayanan has a best-in- class strategy, strong execution capabilities, and an emphasis on quick, decisive action. The key future trends are 1) a rise in consumption of ready-to-cook (RTC) products in a post-COVID world; 2) continued spree of new launches and entry into new sub-categories; 3) focus on volume growth and increasing shift from the unorganized to the organized sector 4) adoption of a new regional cluster-based approach and 5) the out-of-home consumption opportunity, which will change considerably in a post-COVID-19 world.

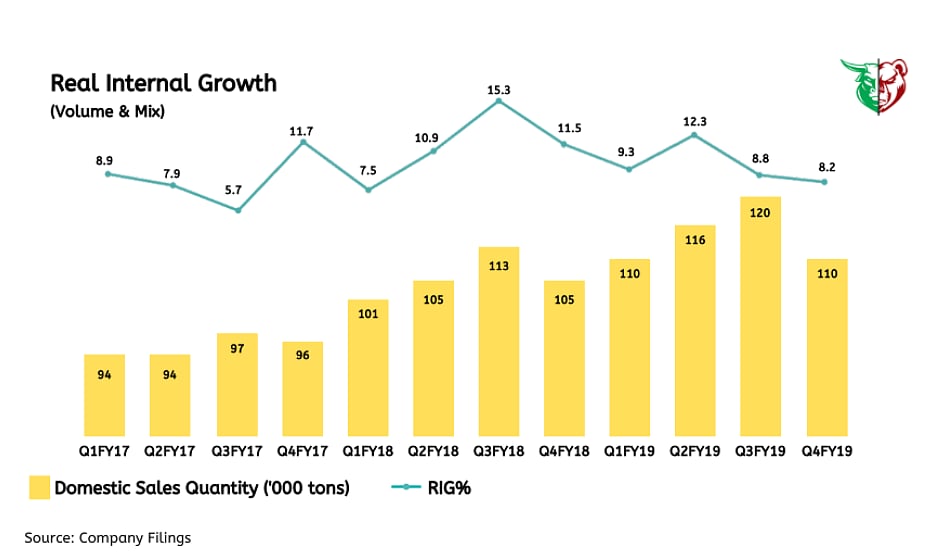

Robust domestic growth in Calendar Year 2019

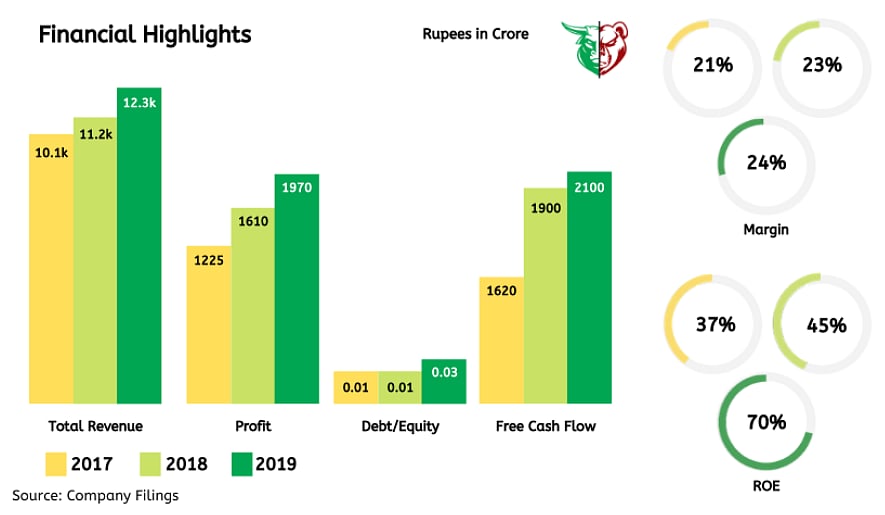

Domestic volume and mix growth, which is measured as real internal growth by the company, came at 9.7%, making it the third consecutive year of high single-digit and double- digit volume and mix growth. The performance was driven by the chocolates & confectionery and the prepared dishes & cooking aids divisions, while beverages had a subdued year owing to a decline in coffee exports to Turkey. The increase in ad-spends on a yearly basis at 8% was modest, relative to last year at 44%. EBITDA margin contracted by 41 bps, largely driven by inflationary pressures in milk and its derivatives.

Business Progress

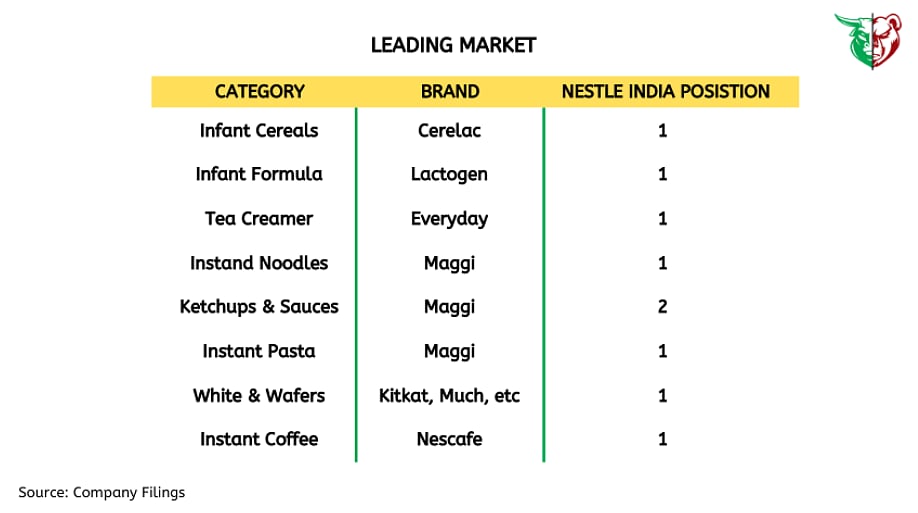

Nestle stayed on the growth path by investing in cutting-edge science and innovation which has led to 71 innovations since 2016, which now contribute 3.4% to the company’s domestic sales. Nestle continues to remain the market leader in ~85% of its portfolio and aims to grow ahead of the industry. The company is already the market leader in seven of eight categories and No. 2 in the rest.

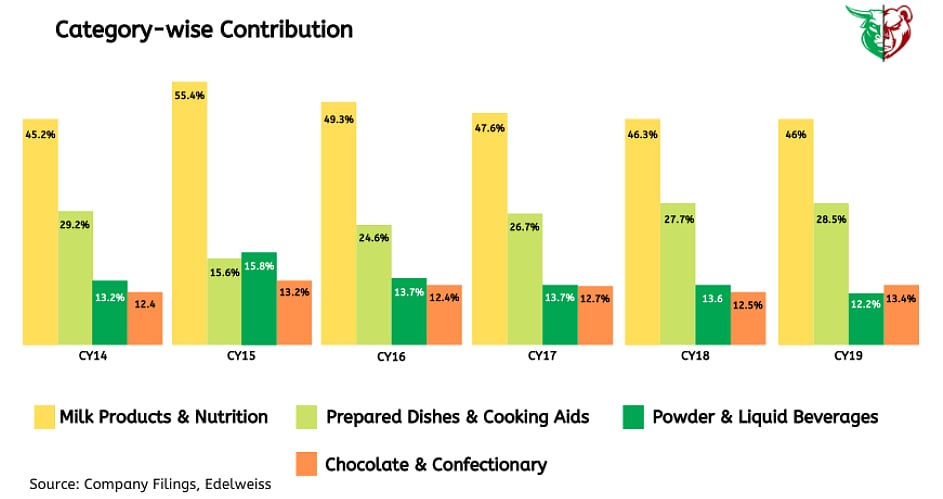

Category-wise contribution

On a consolidated basis, the contribution of prepared dishes is approaching pre-MAGGI crisis levels standing at 28.5% versus 29.2% pre-crisis. The contribution of milk products and nutrition category has slipped a bit, while the chocolate & confectionery category has seen a jump led by the robust performance of Kit-Kat. Beverages have more or less stagnated over Calendar Year 2014-2018, with a dip in Calendar Year 2019 due to lower coffee exports to Turkey.

Rising demand for RTC foods

The consumption of ready-to-cook (RTC) foods is expected to increase in a post-COVID world, with elevated hygiene consciousness. Nestle’s products in this category which contributed 29% of Calendar Year 2019 sales like Maggi Noodles, Pasta, Upma, Poha could see significant demand growth.

Revving up the innovation engine to drive volume growth

Nestle is launching innovative products at 3 times the pace of five years back as it focuses on volume-led penetration. With a success rate significantly higher than the industry, new launches have contributed up to 4% to revenue over the past four years. Therefore expect new launches to continue apace (1-2 new products a month), likely aided by additions from the parent’s global portfolio.

Risks

Slower-than-expected volume growth in mainstay products and brands

Weak demand traction in new product launches

Higher-than-estimated input cost inflation

A sharp increase in competitive intensity. Increasing competition from Abbott Healthcare could be a risk, as Abbott’s market share in infant nutrition has been increasing

Teji or Mandi?

Nestle is one of the best plays in the Indian processed food industry, which has multiple growth drivers in place, including low penetration levels, rising income levels, urbanisation, and changing lifestyles. Nestle, with established brands across food categories, is expected to be a major beneficiary of this growth

Therefore our take is Teji as a largely staple portfolio skewed towards the food and nutrition segments, large market sizes, and dominant market shares increase Nestle's immunity score vs. COVID and consistent volume growth delivery restores confidence in Nestle's growth story.

Teji Mandi is a proactive investment manager for everyone. To read more of our research,

Please visit https://tejimandi.com/research for more details.