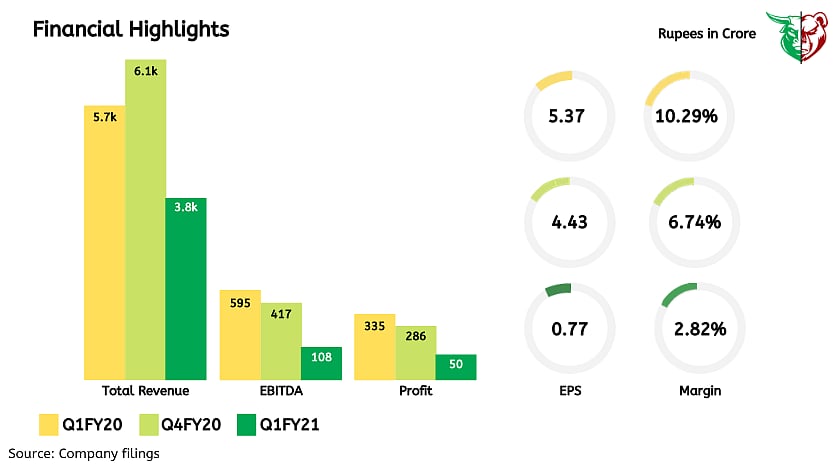

Avenue Supermarts’ (DMART) first quarter of the Financial Year 2021 result was operationally in-line while Profit was better than expected due to higher other income. Store shutdowns, restrictions on selling high-margin non-essential products, and strict social distancing norms inside the stores contributed towards dull performance during the quarter. However, online sales remain strong as customers prefer safety and convenience. Given the strength of DMART’s balance sheet with Rs 2,900 crore unutilized money from QIP, it would be a favourable time to bargain real-estate and further strengthen competitive moats.

Business operations

Sales have recovered to 80% or more of pre-COVID sales in most stores wherever stores were allowed to operate without any obstruction. Discretionary consumption continues to be under pressure, especially in the Non-FMCG categories, impacting gross margins negatively. Store operations and duration of operation per day remain inconsistent across cities due to strict lockdowns enforced by local authorities from time to time. Besides, in certain cities, authorities are once again insisting on selling only essential products.

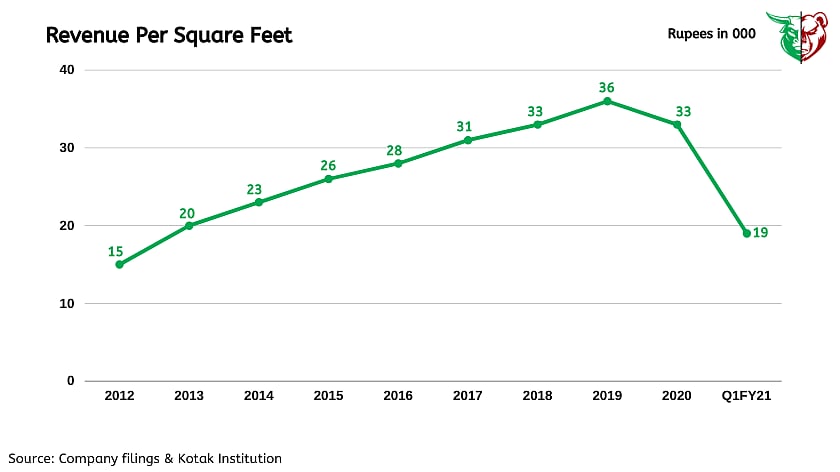

Revenue per Sq.ft declined 47% yearly

Revenue per sq. ft declined 47% since last year as COVID-related disruptions dragged down revenues in the first quarter of the Financial Year 2021. COVID-19 has impacted revenues in multiple ways because of lower footfalls due to timing restrictions, curbs on movement of people and store timings, curbs on the sale of general merchandise in certain stores, and sharply lower pace of store addition.

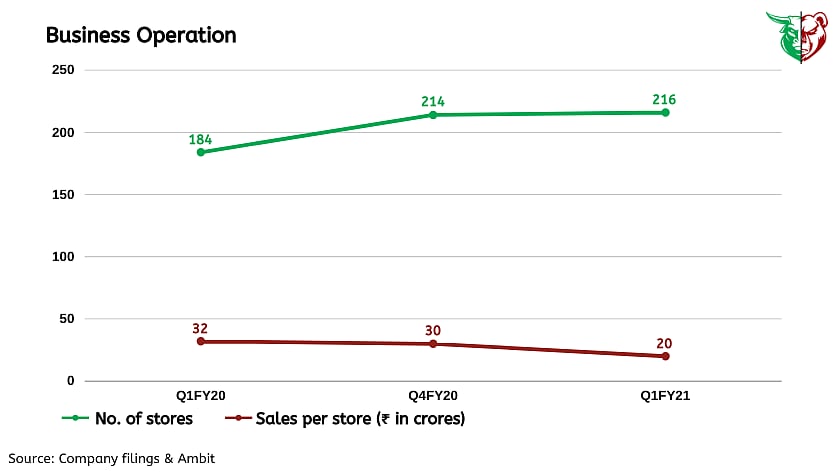

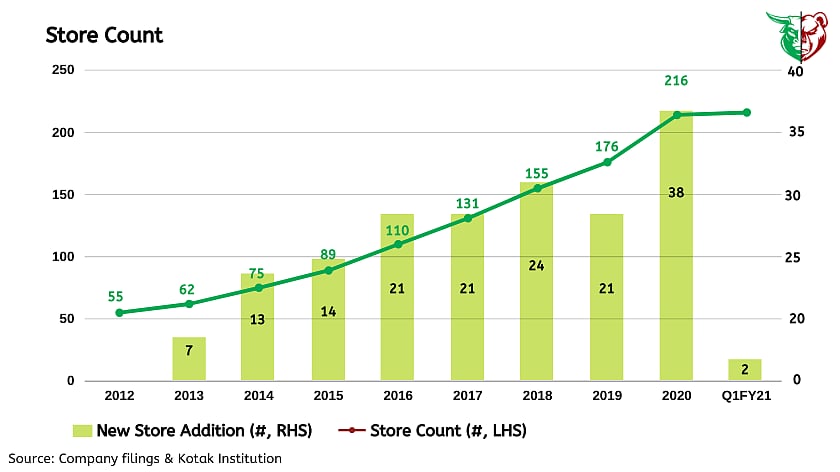

Store count now at 216

DMART added 2 new stores in the first quarter, exceeding expectations, particularly in the light of almost nil construction activity during the shutdown. The company is planning to build 24 additional stores in the current Financial Year 2021 and expect most of these stores to commence operations in the second half of the Financial Year 2021. Store sizes are on the rise, with an average new store size of 100,000 sq. ft, significantly higher than the average store size of 37,037 sq. ft.

The DMART Business Model

After the passage of 3 months, the management said that with further certainty our business model of store ownership, steady incremental store additions over time, and a strong focus on cost efficiency during usual times has allowed the business to face the pandemic shocks with relatively less harm. While we are in the midst of the second wave of the pandemic and business outlook may continue to seem uncertain, the management believes that they are less anxious than they were at the beginning of April 2020.

Online Sales

DMART Ready sales in Mumbai have grown very well and the management is making all attempts to scale it up in a meaningful manner. They have started Home Deliveries (using DMART Ready App) through its stores across the rest of the cities but discontinued it once the stringent lockdowns were withdrawn and stores were allowed to open for business.

Downward factor

Fall in the company's sales per sq. ft. as customer billings dropped amid the lockdown and rise in COVID-19 cases

Less established in E-commerce zone

A slowdown in the economy

Customers preferring local Kirana stores

Teji or Mandi?

DMART's first-quarter performance was in line with the street's expectation with a positive management commentary reiterating that the company recovered to 80% or more of pre-COVID sales in most stores and the business model on which DMART is working allowed it to face fewer harms. The management also said that while we are in the midst of the second wave of the pandemic and business outlook may continue to seem uncertain, we are less anxious than we were at the beginning of April 2020.

Although the company has reported a fall in all parameters in the first quarter of the Financial Year 2021 our take is Teji despite the near term slowdown, DMART’s long-term investment case remains compelling, driven by multi-decade growth opportunities in the modern grocery retail where DMART, with its focus on value retailing and low-cost approach, has a winning business model.

Teji Mandi is a proactive investment manager for everyone. To read more of our research, please visit https://tejimandi.com/research