In this edition of Annual Report Insights, we analyse Infosys' Financial Year 2020 Annual Report. We conclude that the company's strategic objective is to build a sustainable organization that remains relevant to all its stakeholders. Creating growth opportunities for employees, generating profitable growth for investors and contributing to the communities remains on the agenda of the company. With COVID-led disruption, we believe that the ongoing pandemic will fundamentally alter businesses, and technology will occupy centre stage. It is likely to suit Infosys.

Teji Mandi

Focused on moving to pre-COVID growth aided by opportunities for expanding margins

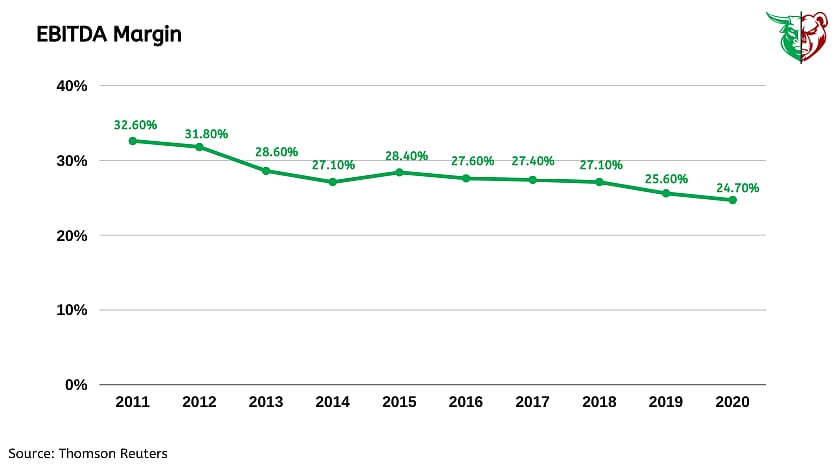

Infosys grew at 9.8% in Financial Year 2020, the company’s focus is to reprise similar momentum after once the current pandemic subsides. Growth will be led by multiple opportunities in digital transformation, core modernization, and vendor consolidation opportunities. Infosys’ has an opportunity to improve its EBIT margin in the medium to long term through a better pyramid, nearshoring, selective price increases in digital competencies, and offshore shift.

Teji Mandi

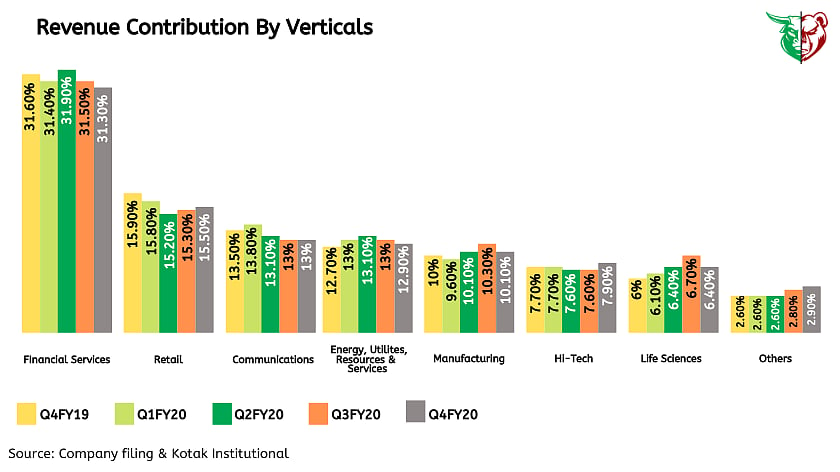

Weakness expected to broad-based across verticals and geographies

Infosys expects revenue weakness to be broad-based across all verticals. However, relatively better performance is expected among communications, Hi-Tech, Lifesciences, and the Consumer Staples verticals. Strength in the quarter was led by the Hi-Tech and the "Others" segment with Quarter-on-Quarter (QoQ) growth of 2.5% and 2.1% respectively with Retail and Energy & Utility revenues also holding up reasonably well with revenue declines (USD) being small at 0.1% and 0.6% QoQ respectively. From a geographic standpoint, developed markets did relatively better in the quarter with India revenues declining sharply followed by the Rest of World (RoW).

Teji Mandi

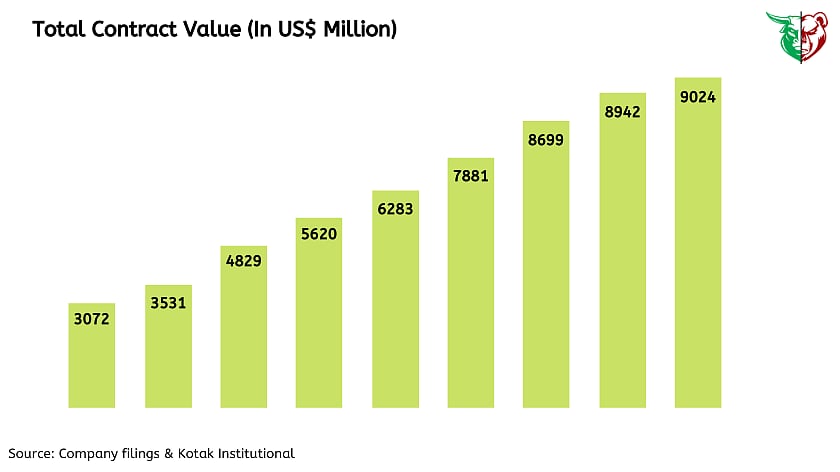

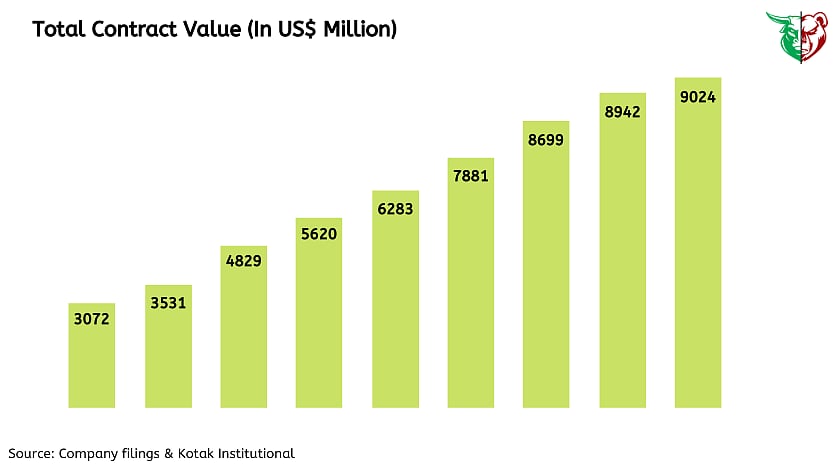

Deal closures strong especially in the context of the tough environment

Large deal Total Contract Value (TCV) was $1.65bn in the last quarter translating into an aggregate TCV of $9bn for Financial Year 2020 representing a growth of 43.5% since last year. New deals represented a healthy 56% of the total in the last quarter with many of these deals having been signed in the last few weeks of March.

However, conversion of this pipeline remains critical in the near term. Deal transitions won in the earlier quarter are progressing well and being handled remotely.

Teji Mandi

WFH transition managed seamlessly

Infosys indicated that the initial focus of clients during the Covid-19 pandemic was on (1) ensuring employee safety and (2) minimizing disruption to existing operations and ensuring continuity of service delivery. Infosys has handled supply-side constraints well during April and May and has increased Work From Home (WFH) enablement to 99% of the workforce, up from 93% at the end of March. Currently, 5% of Infosys’ employees work at campuses and offices. The company has managed project transitions and complex implementations seamlessly through its WFH model.

Teji Mandi

Well-poised to gain from vendor consolidation

Vendor consolidation discussions with clients are at an early stage, but Infosys is confident that it can gain share from (1) large vendors who have not managed WFH transition as seamlessly as Infosys and (2) smaller players that lack the ability to scale up operations quickly and (3) those with weak financial positions. Proven strength in service delivery, strong financial position, and strong client relationships position Infosys well in the vendor consolidation exercise that has begun.

Downward factor

Slower pickup in IT spend

Competition from firms that offer technology-based solutions to business problems

Insourcing of technology services by the technology departments of the company's clients

Weakness in Indian currency against USD, Euro, and GBP

Teji or Mandi?

Infosys is India’s second-largest provider of consulting and IT services to clients across the globe. It is also among the fastest-growing IT services organization in the world and leader in the offshore services space having pioneered the Global Delivery Model.

We believe that the company’s ongoing strategic cost optimization levers around automation, pyramid rationalization, on-site-offshore subcontractors will continue going forward and are confident that the company’s proximity to its clients will enable it to weather this storm.

Therefore our take is Teji as Infosys has its opportunities in digital especially in the areas of cloud computing and artificial intelligence. Apart from this, a debt-free balance sheet and a superior local currency credit rating of A3 from Moody's gives Infosys an enormous advantage during these tough times.

Teji Mandi is a proactive investment manager for everyone. To read more of our research, please visit https://tejimandi.com/research