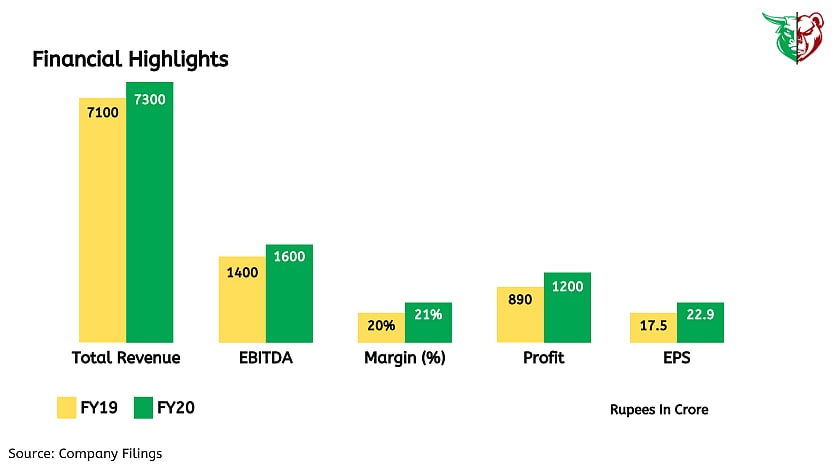

Pidilite Industries’ (PIDI) fourth quarter ended in the financial year 2020 saw a revenue decline of 6% since last year as volumes slipped 3% in the domestic consumer & bazaar (CBP) segment. Operating margins expanded 250bps since last year to 19.5% primarily due to lower raw material cost, resulting in EBITDA growth of 8% as compared to last year. As normalcy returns, Pidilite's operational ability and market leadership position will help regain volumes.

COVID-19 impact and demand outlook

The March quarter performance was significantly impacted by the lockdown on account of the pandemic as well as related disruptions in the supply chain. While top-line growth remains subdued, earnings have improved substantially, primarily as a result of softer input costs.

COVID 19 is a significant challenge and Pidilite remains committed to working with its partners to overcome this crisis. As normalcy returns slowly across various markets Pidilite remains cautious and focused on restoring volumes enabled by investments in brand building, growth categories, capabilities, and sales and distribution.

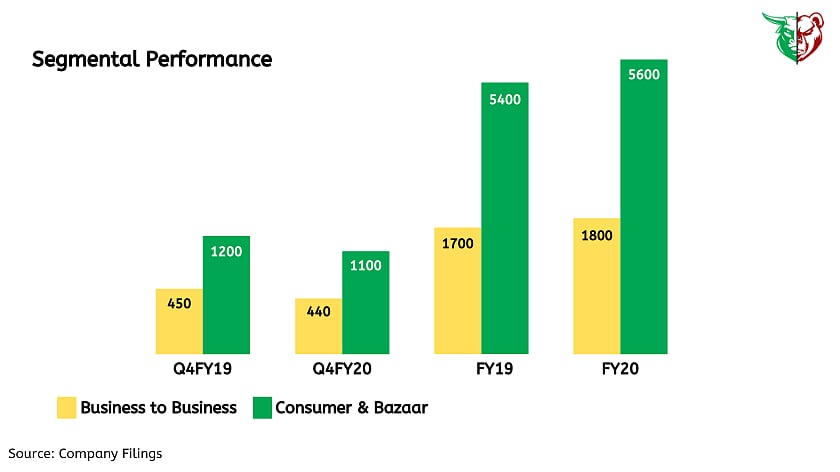

Segmental Performance

Pidilite has restated the segmental details and moved joineries, a few construction chemical brands, waterproofing services, and floor coatings into the B2B segment. The new Consumer & Bazaar segment saw a 4% growth in sales in the financial year 2020, with underlying volume and mix up 1.9%. The B2B segment sales saw 5% growth, with underlying volumes up 3.9%.

For the last quarter, Consumer & Bazaar saw a 5% decline in sales, while the B2B segment saw a 4% sales decline.

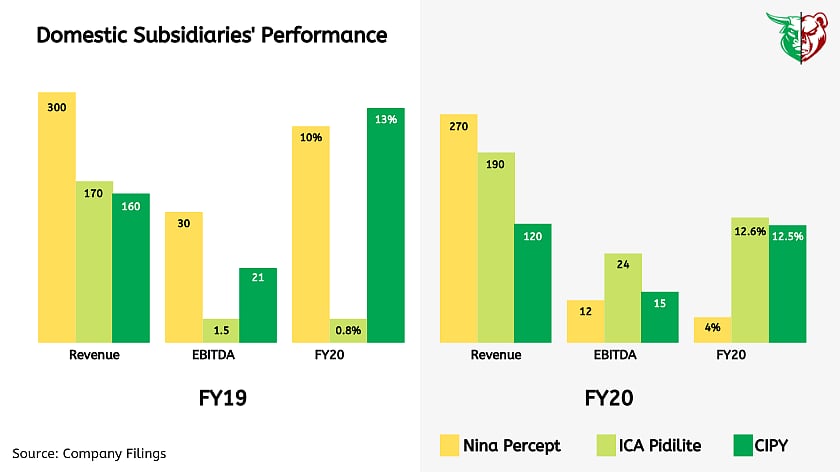

Weakness continues in Nina Percept & CIPY subsidiaries

Among domestic subsidiaries, Nina Percept and CIPY continue to face challenging market conditions in the wake of the economic slowdown in real estate, auto, and the engineering industry. COVID-19 related disruptions have further impacted performance. ICA Pidilite delivered improved margins, given the scale-up in local manufacturing.

Cost control and cash conservation of greater importance

Management plans to cut CAPEX plans that are not required in the immediate future. Also, it would cut spending, wherever possible. It has already cut salary increments to the latter part of the year.

Some non-essential costs, such as ad spends, spends related to physical meetings with dealers would be curtailed in the current environment. However, the company would still continue to invest in digital advertisements.

Investment details

During the quarter, Pidilite through its subsidiary Madhumala Ventures made an investment of Rs 71.5 crore in Trendsutra Platform Services (Pepperfry). Pepperfry is an online furniture marketplace and has operations in India across multiple cities.

Also, it entered into a definitive agreement with Tenax SPA Italy (Tenax Italy) for acquiring 70% of the share capital of Tenax India Stone Products Pvt. Ltd. (Tenax India) for cash consideration of approximately Rs 80 crore. Tenax Italy is the leading manufacturer of adhesives, coating, surface treatment chemicals and abrasives for the marble, granite and stone industry.

Teji or Mandi?

Pidilite is the largest player in the consumer adhesive and sealant industry. It is an iconic brand in the domestic adhesives segment, where it is synonymous with the product itself. It has leveraged Fevicol's favourable market presence to acquire and develop new products and variants and build its market position. Having a well-established brand and the ability to customise the product portfolio provide the company, a competitive edge over unorganised players.

Therefore, our take is Teji for Pidilite as operating performance is likely to remain strong, and the management will remain focused on growing the business in existing product lines where it has an established market position. However, there are some risks such as economic slowdown, increase in competition, and weakness in the rupee that can impact the performance going forward.

Teji Mandi is a proactive investment manager for everyone. To read more of our research, please visit https://blog.tejimandi.com