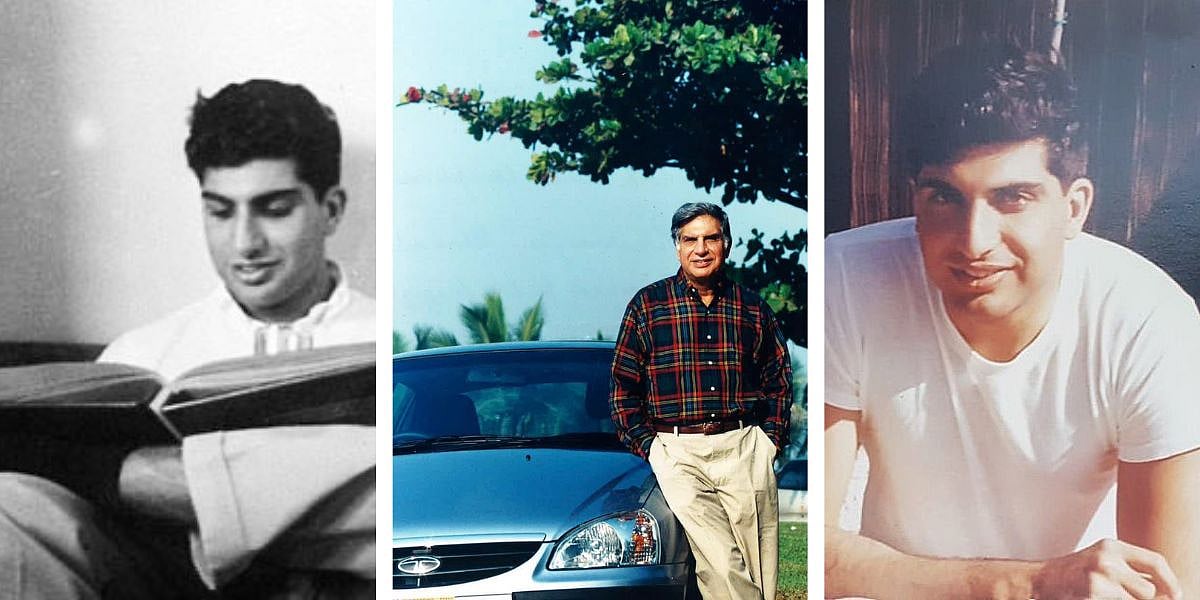

Ratan Tata, the renowned business magnate celebrating his 86th birthday today, will sell his 77,900 shares in the upcoming Initial Public Offering (IPO) of the Mother and child care e-commerce platform, FirstCry.

Tata acquired a 0.02 per cent stake, valued at Rs 66 lakh, in FirstCry's parent company BrainBees Solutions. Today, on December 27, BrainBees Solutions filed its draft red herring prospectus (DRHP) with the market regulator SEBI, aiming to raise Rs 1,816 crore through a fresh issue of shares.

According to the DRHP submitted to SEBI by FirstCry, Tata's average share acquisition cost stands at Rs 84.72 per share.

FirstCry IPO

BrainBees Solutions, the parent company of FirstCry, has filed the Draft Red Herring Prospectus (DRHP) detailing an Offer-for-Sale (OFS) of 5.4 crore equity shares. According to the DRHP submitted to SEBI by FirstCry, the company aims to raise Rs 1,816 crore through a fresh issuance of shares

As part of the OFS, SVF Frog, a SoftBank entity registered in the Cayman Islands, will sell 2.03 crore equity shares of Brainbees Solutions Ltd. Additionally, automaker Mahindra & Mahindra (M&M) intends to offload 28.06 lakh shares of the company. SoftBank currently holds a 25.55 per cent stake in Brainbees Solutions, while M&M owns a 10.98 per cent stake in the multi-brand retailing platform.

Besides SoftBank and M&M, other entities participating in the OFS include PI Opportunities Fund (86.01 lakh shares), TPG (38.99 lakh shares), NewQuest Asia Investments (30.14 lakh shares), Apricot Investments (25.23 lakh shares), Valiant Mauritius (24.04 lakh shares), TIMF Holdings (8.37 lakh shares), Think India Opportunities Fund (8.37 lakh shares), and Schroders Capital (6.17 lakh shares).

FirstCry intends to use the funds raised from the IPO to establish modern retail stores and warehouses throughout the nation. Kotak Mahindra Capital Company Ltd, Morgan Stanley India Company Private Ltd, BofA Securities India Ltd, JM Financial Ltd, and Avendus Capital Private Ltd, will be acting as the book-running lead managers.

Financial Highlights

In the fiscal year 2023, FirstCry recorded revenue of Rs 5,632 crore from its operations, accompanied by a substantial losses, soaring over sixfold to Rs 486 crore from Rs 79 crore in the fiscal year 2022.

About FirstCry

Established in 2010, FirstCry stands as India's foremost multi-channel, multi-brand retail platform catering to mothers, babies, and kids. Its inception aimed to develop a comprehensive hub meeting parenting requirements encompassing commerce, content, community involvement, and education. This initiative was built on fostering brand affinity, customer loyalty, and trust.