The Hindu Undivided Family is also known as HUF. By forming a family unit and combining your assets into a HUF, you can reduce your taxes. HUF and its members pay different taxes.

Hindu families have the ability to unite and create HUFs. Sikhs, Jains, and Buddhists are also able to organize an HUF. HUF files tax returns on its own behalf, apart from its members, and has its own PAN.

Coparceners are people who are part of the HUF. They have ties to the family patriarch as well as to one another. HUF may have a large number of members, but those who are within four generations, including, the head of the family, are referred to as co-parceners.

Those who are born with a joint family property interest are considered Hindu Coparcenaries. Previously, coparceners were exclusively men. Daughters have also been granted coparcenary status as of September 6, 2005. Note that the only people with the right to partition are the coparceners.

Taxation of HUF

HUF files a separate tax return and possesses its own PAN. Since the Hindu family business has an entity apart from its members, a separate joint venture is established.

The HUF may include claims for Section 80 deductions and other exemptions in its income tax return.

HUF is able to purchase a life insurance policy for its members.

Coparceners of HUF are eligible for salary payments if they make contributions to the organization's operation.

The HUF's income can be reduced by this salary expense.

HUF's income can be used to make investments.

The HUF is responsible for paying taxes on any profits received from these investments.

The tax rates applicable to an individual also apply to a HUF.

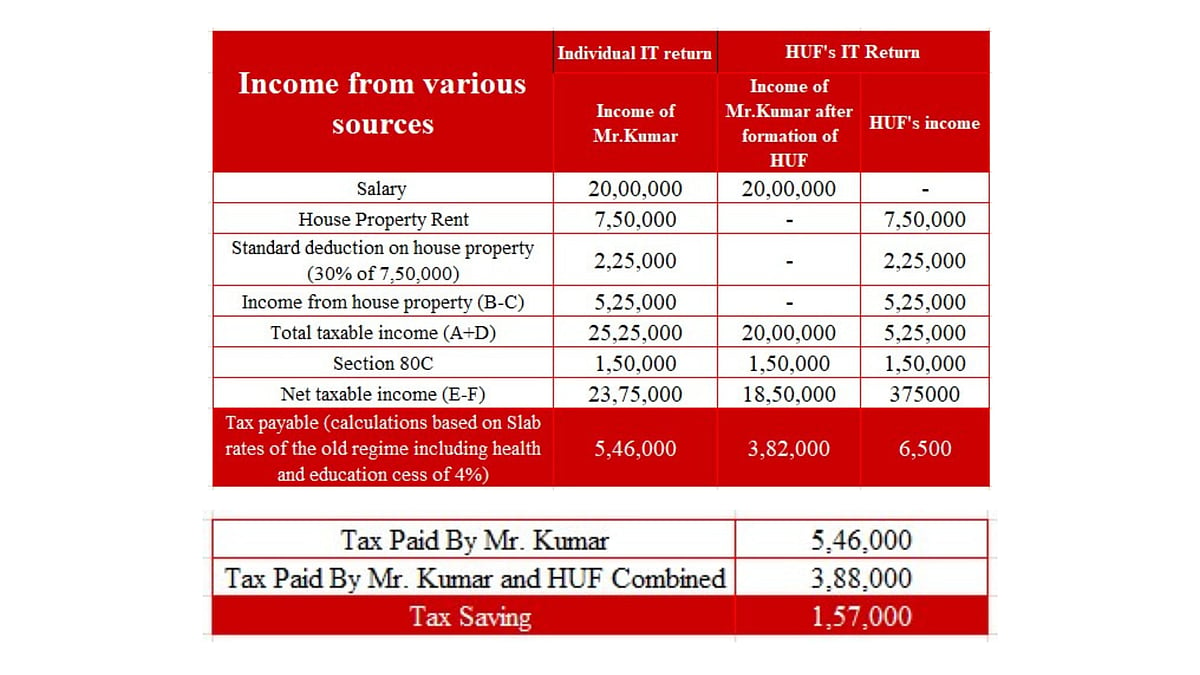

The data given below describes how an individual can save tax with a HUF

Demo Calculations with and without HUF |

How to create an HUF?

HUF can only be formed by a family; it cannot be formed by a single person.

Marriage has the potential to create a HUF. The husband, wife, and kids are all included.

All of his lineal descendants, including their wives and single daughters, make up HUF. They all share a common ancestor.

HUFs can be formed by 'Sikhs', 'Buddhists', 'Jains', and 'Hindus'.

Assets held by HUF typically originate from gifts, wills, ancestral property, sales of joint family property, or contributions made by HUF members to the common pool.

A HUF has to be formally registered under its own name as soon as it is formed. Every HUF ought to have a formal deed. Details about the HUF's members and operations must be included in the deed.

It is necessary to open a bank account and PAN number in the HUF's name.

The income tax department acknowledged HUF as a distinct taxable entity. But HUF is becoming less relevant in the modern world, where nuclear families are the new norm.

There have been numerous instances where families or couples are at odds over shared household expenses, let alone the pooling of assets. The significance of HUF as a tax vehicle is diminishing due to the increase in divorce rates.

(The calculation given in the table above is a demo. The calculations of one's individual taxation may vary depending on the specific circumstances of the person in question. consult a professional for better understanding of your individual case