The shares of HDFC Bank zoomed almost 4 per cent on the NSE (National Stock Exchange) after declaring their quarterly financials for quarter ended at September 30 for financial year 2024.

The HDFC bank shares jumped 3.94 per cent, to a day high level of Rs 1,748.15 per cent after India's one of the biggest private lenders, HDFC Bank, reported on Saturday that its Q2 FY25 net profit climbed 5.3 per cent year-over-year (Y-o-Y) to Rs 17,835.91 crore, exceeding street projections of a flat bottom line.

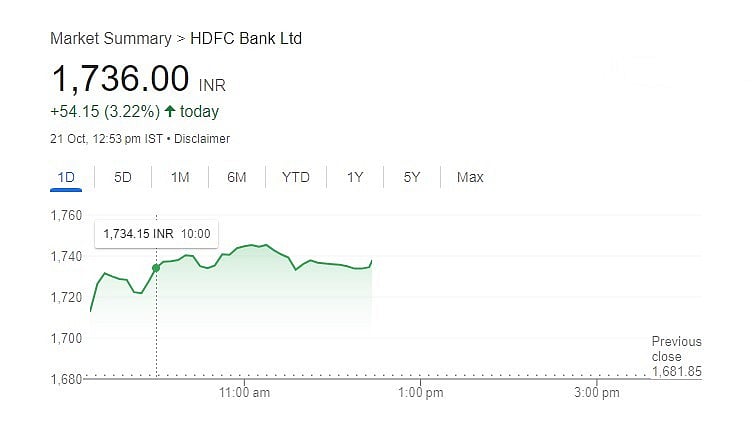

The shares hit the opening bell at Rs 1,715.00 per share on the NSE (National Stock Exchange). The shares were currently trading around Rs 1,737.75 per share on the Indian stock exchanges.

HDFC bank Q2 FY25

Net profit Q2 FY25

In Q2 of FY25, the bank's net profit increased 6.03 per cent to Rs 17,835.91 crore on a consolidated basis from Rs 16,811.41 in the same period last year.

Net interest income and margin

The core net interest margin (NIM) of India's largest private lender by market value was 3.46 per cent on total assets and 3.65 per cent on interest-earning ones in the September quarter, compared to 3.47 per cent and 3.66 per cent, respectively, in the previous June quarter.

The bank reported interest income of Rs 74,017 crore during the quarter compared to Rs 67,698 crore in the same period a year ago. The Mumbai-based lender's total income increased to Rs 85,500 crore during the quarter under review compared to Rs 78,406 crore in the same period last year.

NPA (non-performing assets)

With gross non-performing assets (NPAs) increasing to 1.36 per cent of gross loans by the end of September 2024 from 1.33 per cent in the previous June quarter, HDFC Bank's asset quality saw a minor decline. Likewise, net non-performing assets (NPAs) or bad loans increased from 0.39 per cent to 0.41 per cent during the June quarter.