Wall Street stocks ended the day higher as the Dow Jones Industrial Average set a new record high and the market recorded its fifth consecutive gain.

S&P 500 increased by 0.3 per cent. The majority of the benchmark index's loss from the previous week was erased by its 1.7 per cent weekly gain. The Nasdaq composite increased 0.2 per cent, while the Dow gained 1 per cent as it pushed past its most recent peak set last week.

Over the past few weeks, markets have fluctuated, losing ground before the November elections, rising after Donald Trump's win, and then falling once more. This week, the S&P 500 has been rising steadily, coming very close to hitting its record. It is currently within roughly 0.5 per cent of the peak it reached last week.

The S&P 500

US market’s broad representative index, the S&P 500 did not show a lot enthusiasm, just staying above the closing bell level of previous trading session. The broad representative index did started its trading session with opening in the negative territory, and later resuming its move upwards. The index moved in the limited levels after the flat opening.

The S&P 500 went on to touch the day high level of 5,972.90 points after hitting the opening bell at 5,944.36 points, on the Us bourses. The index surged less than half percentage in trading session. The index was closing its gap towards all time high levels of 6,017.31 points. The S&P 500 concluded the last trading session of the week at 5,969.34 points, after tiny surge of 0.35 per cent amounting to 20.63 points on the US bourses.

Nasdaq Composite

The tech heavy index, comprising leading tech companies like, AI chip maker Nvidia, smartphone manufacturer Apple, search engine giant Google’s parent Alphabet, and other members of the magnificent seven pack. The Nasdaq composite was trading with a flat move after a big surge fuelled by the euphoria of the president-elect Donald trump, which later carried on by the Chip maker Nvidia churning out its earnings for the Q2 FY25.

The Nasdaq Composite conclude at 19,003.65 points, with a respectable surge of 0.16 per cent amounting to 31.23 points after hitting the opening bell at 18,966.32 points on the US bourse. In the meantime, the index went on to touch the day high level of 19,025.77 points, surging about 59.45 points at the highest level in the trading day.

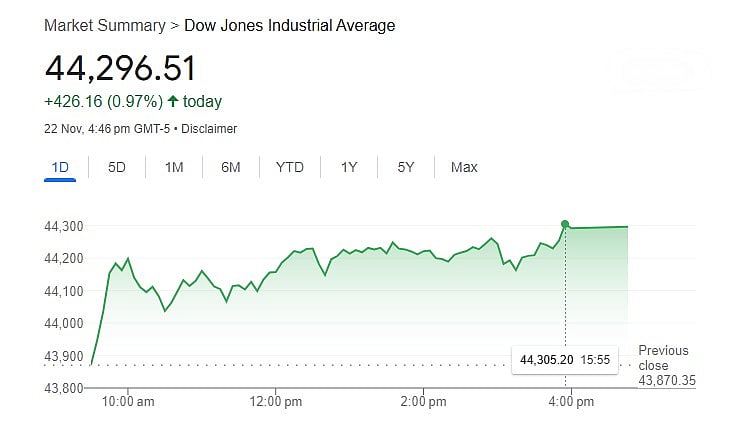

Dow Jones Industrial Average

The oldest index of the US markets, The Dow Jones Industrial Average was taken over by the optimistic bullish traders and investors. After suffering a massive fall which came after the trump effect faded. The Trump Effect, which propelled the indices to the massive upward move later decimated. The index concluded on the high note with a massive jump on the US bourses.

The Dow Jones hit the opening bell at 19,025.77 points, before it went on to touch the life high level of 44,323.95 on the closing basis. The index was controlled by the bulls of the wall street, after the flat opening bell close previous trading session’s closing bell level, the index quickly zoomed touching the day high level. The Index concluded at 44,296.51 points, with a massive rocket up of 0.97 per cent amounting to 426.16 points.

Bitcoin nears USD 100,000

According to CoinDesk, the price of bitcoin was approximately USD 99,000 in the cryptocurrency market. It first crossed the USD 99,000 mark on Thursday and has more than doubled this year.

Economic growth in US

Despite a continuous squeeze from inflation and high borrowing costs, consumer spending has propelled economic growth. The Federal Reserve has begun lowering its benchmark interest rates, and inflation has been decreasing.

That should ease consumer pressure, but any significant change in spending might force the Fed to reconsider its interest rate strategy. Additionally, spending may be reduced by significant reversals in the inflation rate.

US Consumer expenditure data of October

On Wednesday, the United States will release its October personal consumption expenditures index, which will provide a significant inflation update. The PCE is the Fed's preferred indicator of inflation, and this reading will be the final one before the central bank's December meeting.