Cyient Limited, a technology service firm, on Monday (October 28), through an exchange filing announced of a bold acquisition of a 27.3 per cent stake in Azimuth AI, a fabless custom ASIC (Application-Specific Integrated Circuit) company specialising in intelligent energy and power solutions.

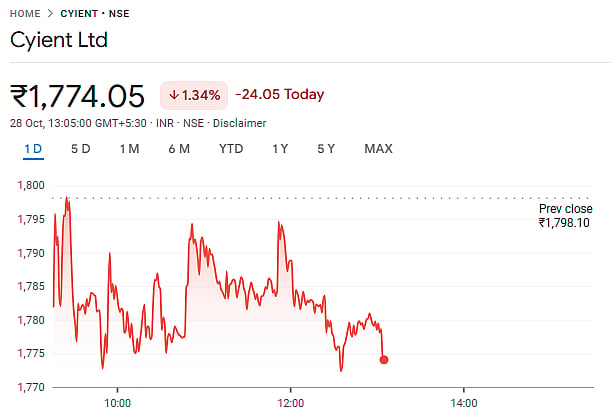

Market Reaction: Cyient’s Share Performance

Cyient’s stock showed some fluctuation in early trading on October 28.

By 12:49 pm IST, the stock was priced at Rs 1,779.50, a decline of 1.03 per cent from its opening value of Rs 1,799.95.

The stock went to a low of Rs 1,763.85, during the intraday session.

Share performance |

Krishna Bodanapu, Cyient’s Executive Vice-Chairman and Managing Director, said “Driven by the Indian Government’s initiatives to boost domestic innovation in semiconductors, India is emerging as a hub for chip development, especially in power and energy-efficient systems. In July this year, we announced the strategic expansion of our Semiconductor business with the establishment of a fully owned subsidiary. Investing in Azimuth AI strengthens our focus on building cutting-edge ASIC chips designed and developed in India - for the world. It further enhances our capabilities in this critical space while reinforcing our commitment to next-gen power and energy solutions. We look forward to this partnership.”

Cyient’s Financial Performance: Q2 FY25

On October 24, Cyient announced its second-quarter financial results, postinng a stable performance.

The company posted a 2 per cent year-on-year surge in net profit, with its Digital, Engineering, and Technology (DET) segment generating revenue of Rs 1,450 crores, reporting a 2.5 per cent growth in comparison to the previous quarter, though a minor 1.8 per cent decline year-on-year.

The DET segment’s EBIT stood at Rs 206 crores, a margin of 14.2 per cent, while profit after tax was reported at Rs 177 crores, a modest 2.3 per cent increase over last year’s figures.