The Q2 earnings season is in full swing, and Black Box Limited, a Mumbai-based IT solutions provider, announced its results for the quarter and for the first half ended September 30, 2024.

Black Box's Q2 Results

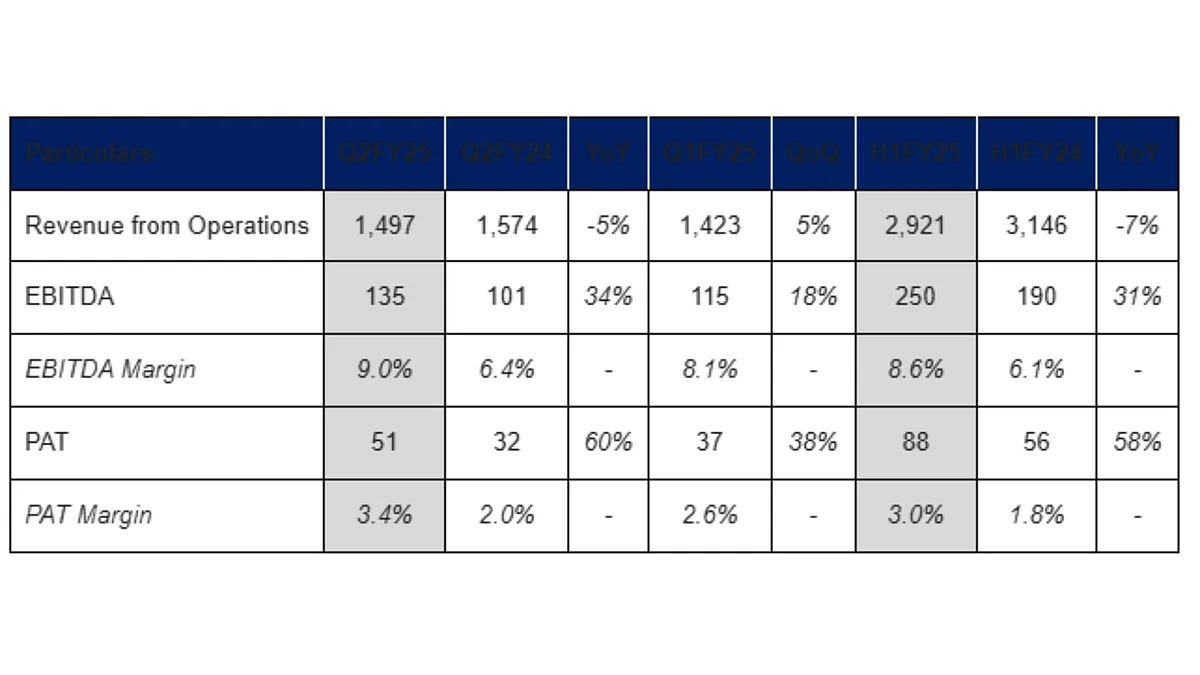

The company reported robust quarterly and half-yearly EBITDA and PAT. EBITDA for the quarter increased to INR 135 crore, reflecting a growth of 34 per cent YoY and 18 per cent QoQ.

For H1FY25, EBITDA grew by 31 per cent YoY and stood at Rs 250 crore. EBITDA margins for Q2FY25 improved substantially by 260 basis points YoY to 9.0 per cent whereas for H1FY25, EBITDA margins improved by 250 bps YoY and stood at 8.6 per cent.

Profit after tax for Q2FY25 stood at Rs 51 crore, growing by 60 per cent YoY and 38 per cent QoQ. For H1FY25, PAT increased to Rs 88 crore, reflecting a growth of 58 per cent YoY. PAT margins improved by 140 bps YoY and stood at 3.4 per cent in Q2FY25, whereas for H1FY25 PAT margins stood at 3.0 per cent, reflecting a growth of 120 bps YoY. Strong operating performance has resulted in better profitability.

Order Book At USD 455 Million

Revenue for Q2FY25 stood at Rs 1,497 crore, compared to Rs 1,574 crore in Q2FY24. For H1FY25 revenue stood at Rs 2,921 crore compared to Rs 3,146 crore in H1FY24. Hold up in decision-making, leading to delayed project execution, impacted revenue. However, the pipeline continues to remain strong with order book at USD 455 million as of September 2024.

The company has reportedly reorganised and renewed its Go-To-Market (GTM) business strategy focused on select industry Verticals for a concentrated approach towards these verticals and simultaneously created a horizontal solutions structure around these verticals to be able to offer a wide range of solutions for deeper engagement with the customers. With a focused approach led by experts in each vertical the Company is gearing up for its next phase of growth, the outcome of which are expected from early FY26 onwards.

The new GTM approach will also allow the company to grow its revenue at a faster pace, will drive operating efficiency, spur innovation, result in deeper client engagements, and be able to build a next-gen global digital infrastructure company addressing the growing demands of AI-led technology advancements including data centres across the globe, creating large opportunity in its existing geographies.

The company has also renewed its focus on 300 of its largest customers for deeper penetration to augment the revenue. Focus on large customers will allow Black Box to offer its wide range of solutions, leading to higher wallet share and further improve operating performance and profitability.

'Propel Growth In Key Focus Areas'

Commenting on the results and performance Mr. Sanjeev Verma, Whole Time Director, Black Box said, “Our strategic focus on reorganising the business into industry verticals and a horizontal business layer will help us to transition into the next phase of growth. A focused approach to targeting premium customers will lead to deeper engagement with our clients making us among the preferred digital infrastructure solutions provider globally."

Sanjeev Verma |

"Additionally, our cost optimisation efforts will yield consistent growth in operating performance and enhanced productivity, leading to better margins. We have secured funding of Rs 386 crore, which will strengthen our balance sheet and help us make accelerated investments to propel growth across key focus areas.”

Mr. Deepak Kumar Bansal, Executive Director and Global Chief Financial Officer of Black Box, commented, “Our commitment towards better performance achieved through operating leveraging is starting to yield results as our operating and profitability margins continue to rise quarter on quarter. As we re-architecture our GTM, we will see further improvement in our operating performance, higher profitability and improved cash flows. At Rs 51 crore of PAT in Q2 FY25 we are already at a run-rate of above Rs 200 crore of PAT and are hopeful to achieve our full year FY25 profitability targets.”