Bajaj Finserv, which was trading around Rs 1,568 per share, saw a decline of 3.08 per cent amounting to Rs 49.80. Bajaj Finserv's share opened at Rs 1600.60 per share Today, and touched a day-high price of Rs 1611.90 Per share

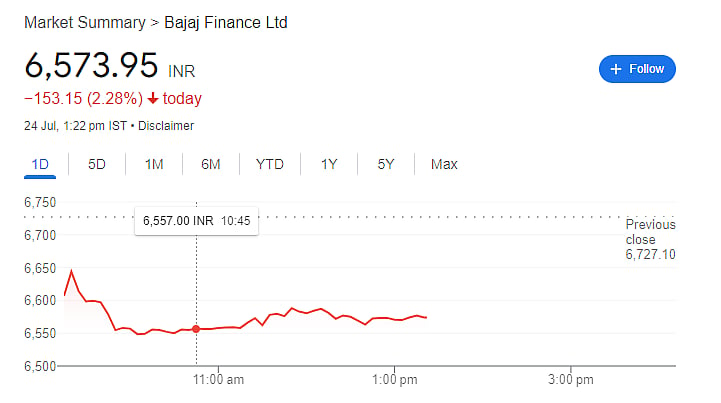

Bajaj Finance's share price tumbled by 2.88 per cent to Rs 6,573 per share, aforementioned company's parent company, Bajaj Finserv, was also trading in red after the Q1 financials.

Net profit Q1 FY25

Bajaj Finserv Ltd. revealed that its net profit for the first quarter of the current financial year increased by 10 per cent to Rs 2,138 crore. At Rs 31,480 crore, the company's total consolidated income increased by 35 per cent (YoY) year over year.

RBI ban lifted

After the RBI lifted the restrictions on these businesses on May 2, 2024, the company said that it had resumed the approval and disbursement of loans under the 'eCOM' and 'Insta EMI Card' programs as well as the issuance of EMI cards.

Net profit Q1 FY25 (Bajaj finance)

Bajaj Finance, a subsidiary of Bajaj Finserv, revealed that its Q1 FY25 net profit increased 14 per cent year over year to Rs 3,912 crore. Net interest income (NII) for the April-June quarter of India's largest non-banking finance company increased by 25 per cent year over year to Rs 8,365 crore.

Bajaj Finance had previously reported in its Q1 business update that bookings for new loans increased by 10 per cent to 1.1 crore.

AUM (assets under management)

At the end of the quarter, assets under management (AUM) had increased by 31 per cent year over year to Rs 3.5 lakh crore. In the quarter that ended in June, the deposit book also saw an increase of 26 per cent YoY to Rs 62,750 crore.

Gross and Net NPA (non-performing assets)

In comparison to 1.09 percent and 0.39 percent as of June 30, 2023, the gross non-performing assets (NPA) and net non-bank lender's NPA as of June 30, 2024, stood at 1.06 per cent and 0.47 per cent, respectively.

.jpg)

.jpg)