The shares of Apollo hospitals surged more than 7 per cent on the NSE (National Stock Exchange), after PAT (profit after tax) zoomed a whopping 63 per cent in the September quarter of the current fiscal year.

The stock went on to touch the day high level of Rs 7,483.90 per share on the Indian Stock Exchanges after hitting the opening bell at Rs 7,316.50 per share on the NSE (national stock exchange) propelling the stock with almost 5 per cent at the opening bell level.

The shares of Apollo Hospitals Enterprise were trading at Rs 7,411.90 per share on the Indian bourses, with gain of 6.37 per cent amounting to Rs 443.80 per share on the NSE (National Stock Exchange).

Apollo Hospitals Enterprise Q2 FY25

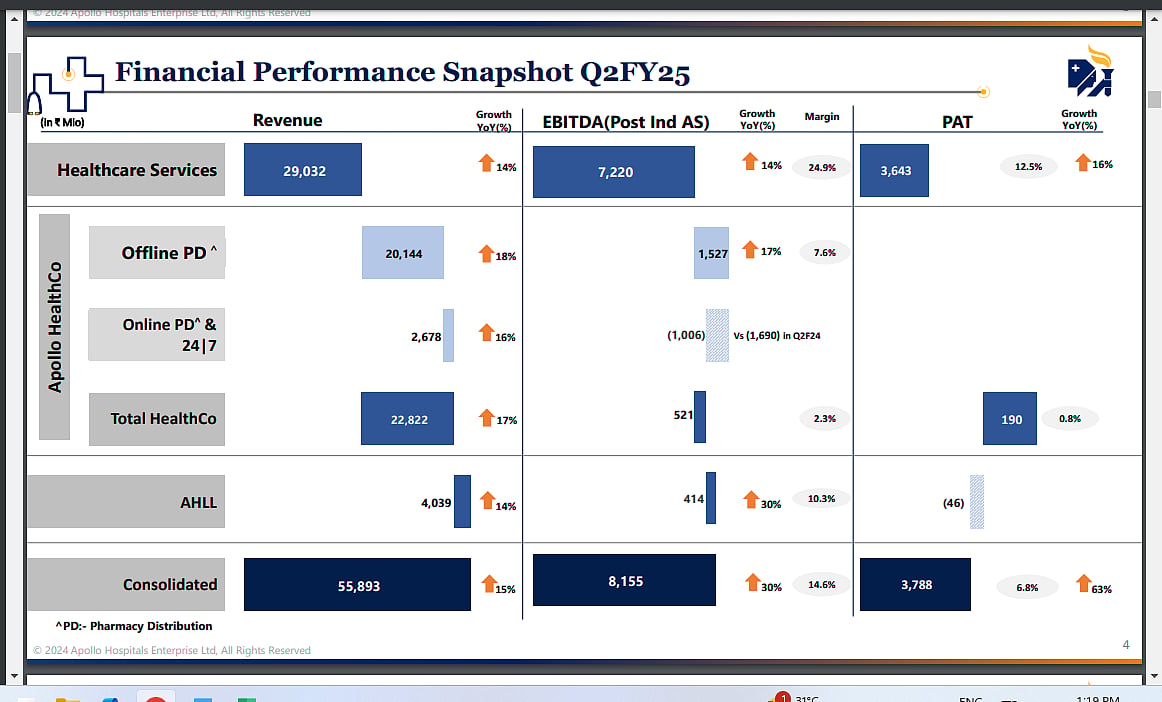

Apollo Hospitals posted its July-September quarter results for fiscal Q2 FY25, showing a 63 per cent increase in consolidated net profit to Rs 379 crore due to increased demand for its medical services, compared to Rs 233 crore during the corresponding quarter in the previous fiscal year.

Q2 FY25 Revenue

In the second quarter of the current fiscal year, the hospital chain operator's operating revenue increased by 15 per cent to Rs 5,589 crore, up from Rs 4,846 crore in the same period last year. By adding more beds and making room for more costly elective surgeries, hospital chain operators have been concentrating on increasing their occupancy rates.

Operational performance Q2 FY25

In terms of operational performance, Apollo Hospital's earnings before interest, taxes, depreciation, and amortisation (EBITDA) increased by 30 per cent to Rs 815.5 crore in the September quarter from Rs 627 crore in the same period last year. The margin increased to 14.6 per cent from 13.6 per cent during the same time last year.

Financial performance of different business verticals

Apollo Hospitals reported , it had 7,994 operating beds and that overall occupancy increased from 68 per cent in the first quarter of last year to 73 per cent in the second quarter. This resulted in a 14 per cent increase in revenue from its healthcare services division, which accounts for over half of its overall revenue.

The hospital chain operator's margins were boosted by the digital health and pharmacy vertical, which provides online consultations and runs the 'Apollo 24/7' platform. This vertical reported a profit of Rs 38.9 crore, up from a loss the previous year.