Angel investor network Agility Ventures on Saturday said it has received approvals from markets watchdog Sebi for an angel fund with a total corpus of Rs 450 crore ($60 million) that will be deployed over the next 3-4 years.

Agility Ventures network invests in startups or early-stage businesses in industries such as education, technology, healthcare, e-commerce, automobiles, electric vehicles, robotics, agri-tech and manufacturing, among others.

For 2022, Agility Ventures has set a target of increasing its network by 4,000, which currently stands at over 1,500 angel investors, a statement said.

With AIFs (Alternative Investment Funds), it is looking at deploying Rs 75 crore this year in over 50 startups, which will also include fintech, cyber security and crypto, the statement added.

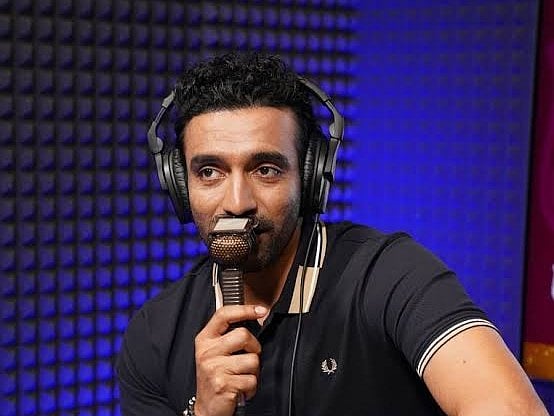

Sebi's approval to launch the fund is just the kind of start Agility Ventures was looking for in this New Year, co-founder Dhianu Das said.

After launching Fluid Ventures (a D2C focused Sebi-registered category-1 VC fund) last year, this is exactly the kind of fuel needed to roll out the plans for 2022, Das said.

''After having invested in 5 companies through Fluid Ventures, we are not only ambitious about deploying Rs 75 crore this year through Agility Ventures angel fund and investing it in over 50 startups but also very focused on achieving it. We are here to create more than just a ripple in the startup investment space and the angel fund will help us reach that goal,” he added.

Prashant Narang, co-founder of Agility Ventures, said the interesting thing about raising the kind of angel fund that has been approved by the Securities and Exchange Board of India (Sebi) is that it is sector-agnostic and does not limit itself to co-investments.

''This model also simplifies the financing process without changing the core style of the angel network. In fact, it adds to the pre-existing angel investor's style of financing, which usually entails Bridge rounds to pre-series A rounds,'' Narang added.

Agility Ventures is a global network spread across 25 chapters in India, Canada, the UAE, Australia and the UK as well. With a legal entity registered in America, they are also setting up a UAE-based team in February.

(With inputs from PTI)