Last week, India’s finance minister, Nirmala Sitharaman, spoke eloquently about how India will witness close to double-digit economic growth this financial year. One hopes this will happen. But such predictions must be taken with a lot of salt.

Reassessments required

A high GDP growth rate on an exceptionally low base (thanks to the steep shrinking of the Indian economy) may actually mean nothing. Moreover, if the World Bank’s latest figures are to be taken at face value, one finds that it has again cut India’s GDP growth forecast for 2021-22, from 10.1% to 8.3%. As Kaushik Basu, former Chief Economic Advisor, India, pit it, “Since growth was -7.3% in 2020-21, this means over two years India’s growth will be [just] 0.49%.”

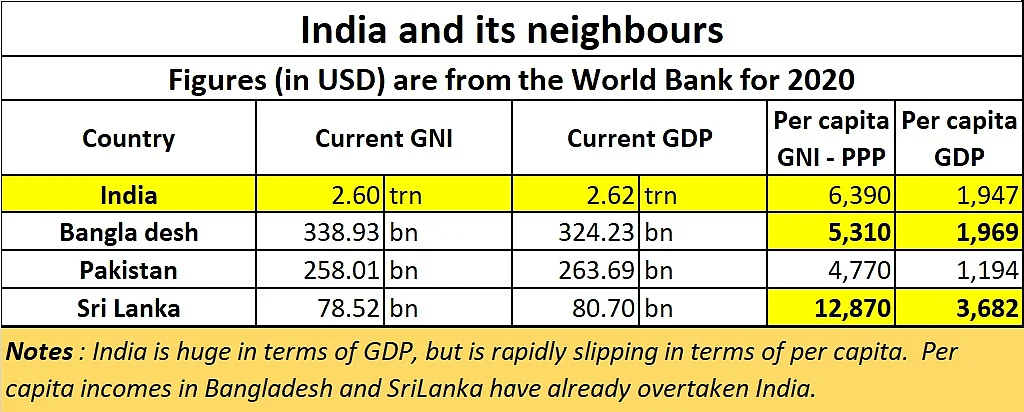

There is something even more important. Mere GDP growth may not mean anything. What matter is the per capita income that Indians enjoy. And that is where India appears to have slipped badly (see table).

This is because if your population is large, your GDP can be large even with a small per capita number. A big GDP gives politicians more money to play around with. But if people in that country cannot be wealthy, then governance is a big issue.

Just look at the per capita income of Sri Lanka, which just a decade ago was war torn. People talked about this country being a basket case because it had sold itself out to the Chinese. But it is when you look at the per capita number, you realise that people in that country are significantly better off, and enjoy more purchasing power.

Ditto with Bangladesh. When the country emerged from a painful separation from Pakistan, it was hugely dependent on doles from India and elsewhere. But its policymakers have managed their affairs better than what India appears to have done.

In fact, it is sad to see India lean toward the US shrugging off the humiliation of the PL480 schemes it subjected India to during the 1970s. This was the scheme under which India imported US wheat. India has forgotten that the US has never really transferred defence technology to India. It gave its buyers knocked down kits which they could screw together. Even the Swiss headquartered Nestle sneered at Dr, Verghese Kurien sought technology for pasteurization. He eventually designed on n his own.

Much of the technology India got – for pharma, steel, defence or even agriculture – came largely from two countries, Russia, and Israel.

USA vs USA

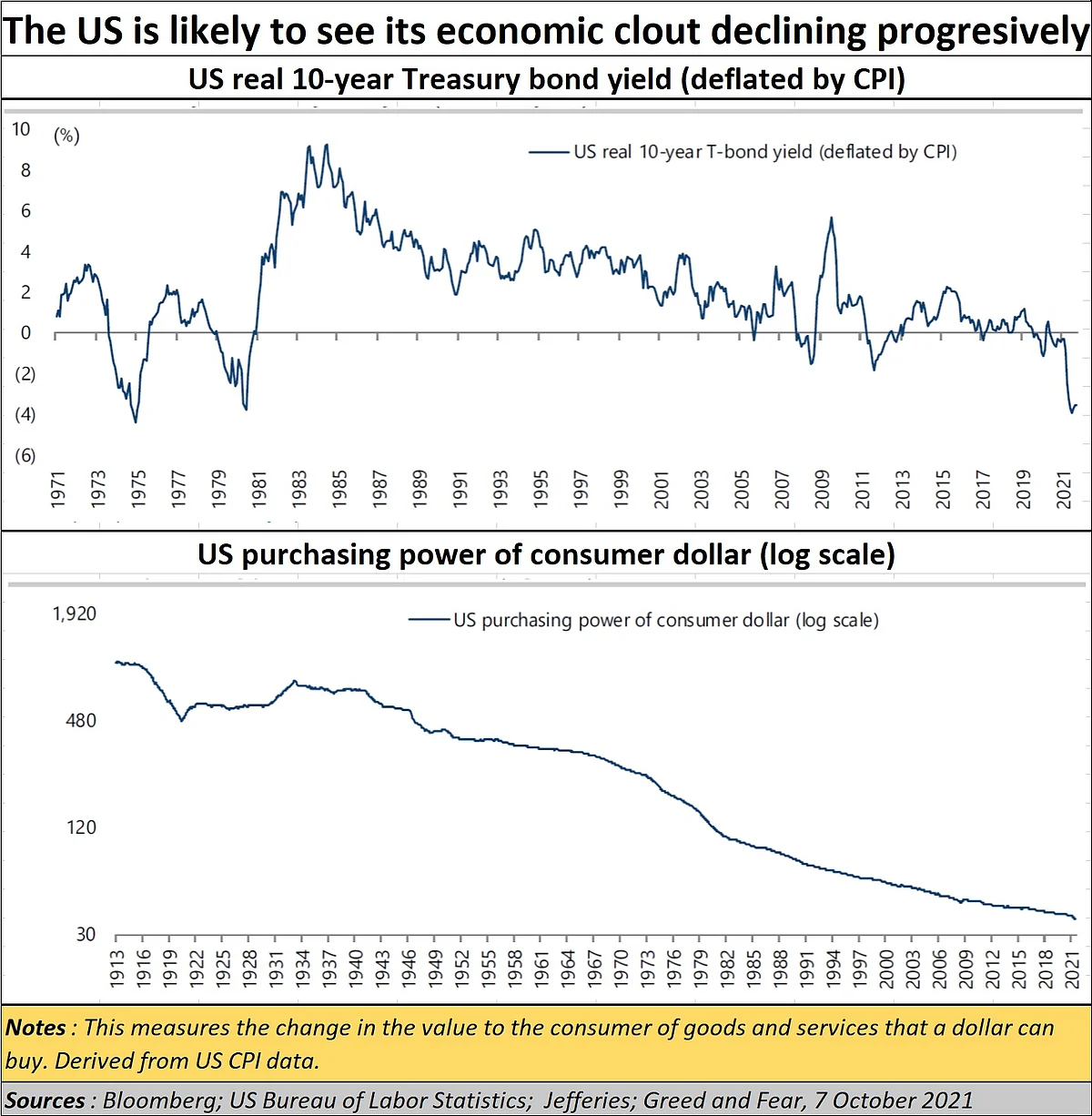

In fact, as things stand now, despite panic screams that media has been making about China’s precarious economy, it is the US which is under immense pressure.

Its purchasing power is diminishing rapidly. It may be the biggest military power in the world today. But unless it can make its dollar stronger, such strengths will become increasingly difficult to sustain.

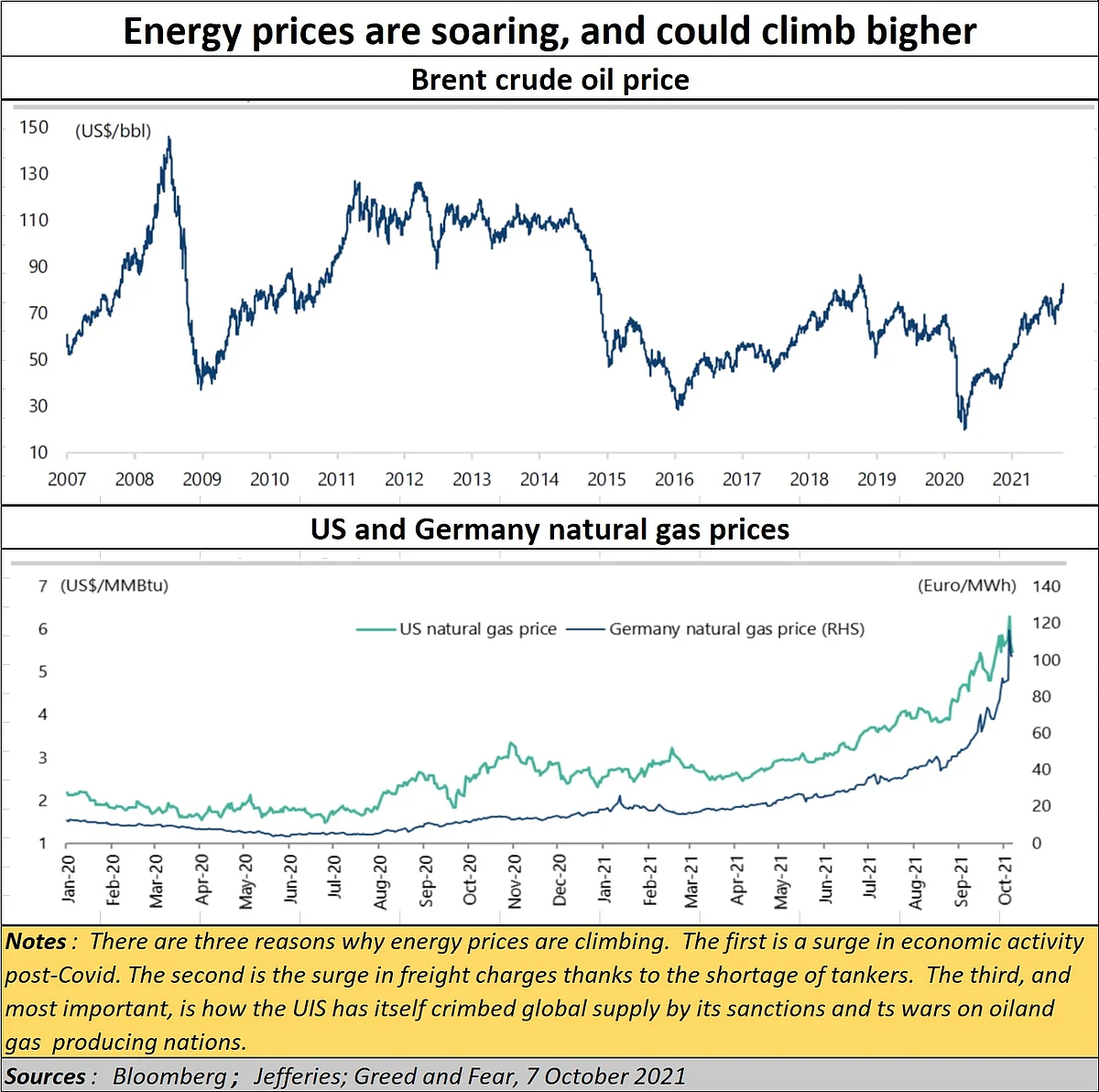

Ironically, the US seems to have become its own enemy. Had it not tried to block Russia from selling its oil and gas to Europe, the latter would not have been compelled to seek out a trade deal with China. Today, much of China’s oil and gas comes through pipelines from Russia, at extremely attractive terms. So, while the world may groan under the burden of higher fuel prices, China is better off, thanks to the US.

Similarly, had the US not tried to embargo Iran from selling its oil, the latter would not have sought out a market in China. Today, the sphere of influence of China with both Russia and Iran has only made China less dependent on oil from the Middle East.

China’s realignments

Moreover, by building the China-Pakistan-Economic corridor, China has reduced the transit time for oil tanker deliveries from the Middle East to its Eastern ports -- from over 12 days to just 2 days. That has also made it sidestep the substantial number of naval bases the US has built along the Eastern coast of China along with its allies.

Almost overnight, almost a quarter of transactions in the world (led by oil and gas from Russia and Iran) are now in the Chinese RMB, not the US$. That has added to the weakness of the US currency.

Instead, the rest of the world must contend with higher fuel prices – and the major beneficiaries are both the Middle East oil producing countries and the US. This is because the oil and gas production in the US itself is not small. Moreover, it has equity stakes in the largest oil exploration centres and refining capacities in the Middle East. In addition, it retains equity stakes in oil exploration centres in South American countries as well.

So, if energy prices go up, the biggest beneficiary remains the USA. That is something few people talk about.

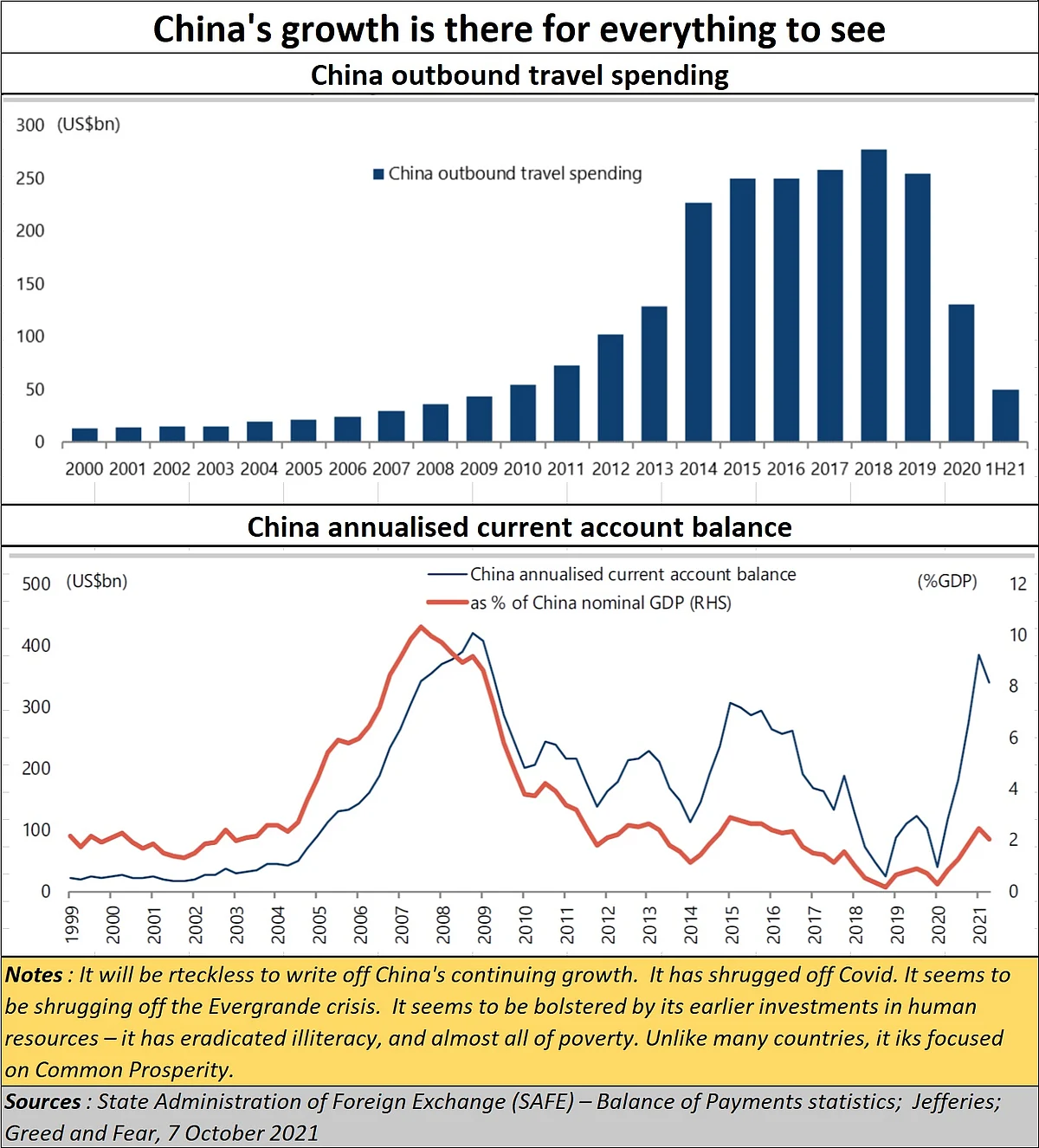

Finally, look at the status of emerging China. It remains focused on economic growth and “common prosperity” -- notwithstanding shrill doomsday cries about the impending crisis that Evergrande (and possibly the smaller Fantasia) will cause to financial markets.

But then, Nostradamus like warnings about China are not new – and most of them emerge from the US or the UK. Both countries excel in the art of disinformation.

People who have travelled through China marvel at its infrastructure, its social stability (despite a poor ratio of girls to boys, you will not hear catcalls on China’s streets), and its focus on growth. It is worth reading a recent tweet about that infrastructure.

India has the population, but not the education, medicare and the focus on growth.

Its most productive populations in the South and the West have witnessed declining growth rates (even below the replacement rate). In sheer contrast, its poorer, less educated, less employable, and more fundamentalist populations in North India continue to grow at a rapid rate.

The fact is that when populations remain less educated, with little medicare and poor, and are often unemployable, the tendency to have more children is well documented. One of the reasons why China’s population (like those in Europe and Japan) is declining is because they are economically better off, better educated, and more employable than many Indians are. The one-child-policy is just part of the whole story.

If the Indian government focusses on providing better education and medicare to the people of Uttar Pradesh, Bihar, and Madhya Pradesh, and makes them more employable and prosperous, you will see birthrates decline there as well, and per capita incomes increase. India has to begin looking to improving education and employability in these regions quickly. Mere announcement of more schemes is not enough. You need good education, medicare and good governance as well.

Eventually, talking about GDP growth rates is not enough. It could be misleading. India must aspire to grow per capita income the way Sri Lanka has done. Just staying ahead of Pakistan is no benchmark.

The author is consulting editor with FPJ