At one level, this should be cause for celebration. Gold imports into India crashed during 2020 (see chart). Lower import of this yellow metal means a smaller balance of payments. Hence there is a cause for celebration.

India normally imports around 800 tonnes of gold each year. But 2020-21 could see it fall to around 100 tonnes. It is early days still, and final figures have yet to come in. But market estimates put this year’s imports at a dismal 100 tonnes.

Lost purchasing power?

But the celebratory mood gets muted when one realises that the slump in gold demand could mean that India suddenly, for the first time in decades, had lost its purchasing power. It could mean that people were so desperate that they could not put money aside to purchase gold. Do bear in mind that much of individual gold is purchased by small income earners – often employed in the unorganized sector. They purchase it for a newly born child, a marriage, or a special gift for a relative. Gold is for celebrations. The inability to purchase gold is an admission that these are not times for celebration any longer.

Even the first wave of the pandemic did not hurt purchasing power as much as is now becoming evident. Or, could it be a delayed reaction because the final numbers had yet to be totted up. However, the manner in which other indicators too point to a worsening of the purchasing power crisis should compel India’s planners to sit up and take a more serious view about developments.

Unfortunately, eyeballs are rivetted on arrests of protestors (even media groups), cases against Twitter, a wild chase to abduct and bring back an absconder. Instead, they should all be focused on ways to create jobs and restore the clout of purchasing power in India. India -- as a big attractive market -- is dying. The gasps can be heard by everyone who cares to listen. Even UBS has finally come out with a statement that it does not expect a V shaped recovery in India for at least a year.

Rural markets matter

It is rural India that sustains the demand for gold.

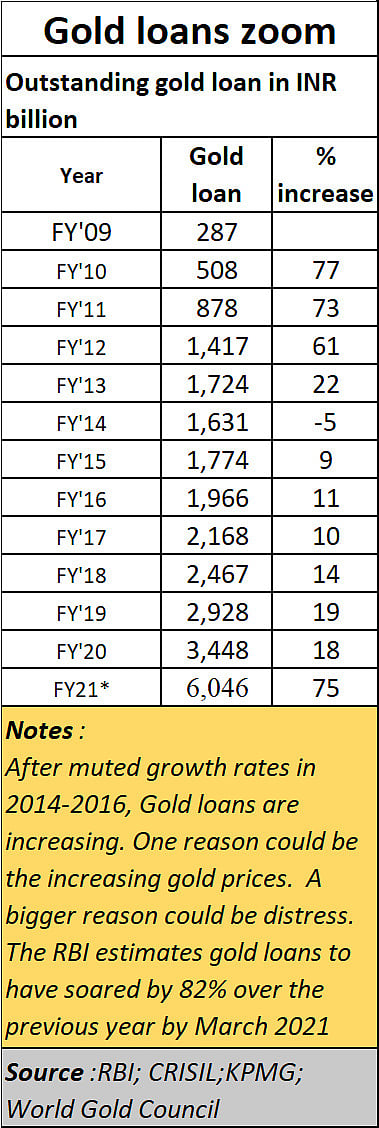

Thus, fall in gold consumption points to a crisis in rural and MSME India. This anxiety is confirmed by another development. Gold loans reached an all time high. Indians normally do not pledge gold unless it is for some dire need that normal sources of income or mortgage-able items cannot fulfil. Indians are sentimental about gold (and property). When gold loans soar, it points to a deep urgency, which left them with no other option but to pledge their gold.

Says VP Nandakumar, MD and CEO, Manappuram Finance, "The national lockdown increased the risk aversion on the part of banks and other NBFCs, leading to a credit squeeze, while surging gold prices led to customers increasingly opting for gold loans.’’

Together, the crash in gold imports and the surge in gold loans point to distress of a type that normal economic indicators do not reflect.

And do bear in mind that the figures captured by the RBI and other agencies relate only to the organised gold loan market. Nobody is willing to talk about how big the gold loan market is in the unorganized sector.

However, they admit that the total gold loan market in the organised sector accounts for just 3.5% of the total gold stocks in the country.

In fact, if one looks at government and market sources, everyone is going overboard in telling people that the worst is over. That the economy is on the rebound. Maybe good days will arrive (finally).

But gold is one commodity that seems to tell another story. The demand for this metal has collapsed to such an extent, that gold prices have also turned soft. After hitting a peak of around Rs.51,000 per 10 grammes on 2 June, it has settled to levels under Rs.50,000 currently. If demand for this metal does not improve, prices could fall further because India and China are the world’s largest consumers of gold.

Unemployment

Take a look at other indicators underscores what is hurting the economy. One of them is the loss of jobs. And job losses are of two kinds.

there is disguised unemployment. As Mint puts it, “More companies are now hiring temporary workers raising their numbers to 35% of their workforce and are comfortable having their employees spread across the country, say human resources consultants. Short-term contracts for specialized roles are becoming the norm. The disadvantage of this, though, is that contract workers have fewer benefits, less job security and are liable to exploitation in a country with a fairly unprofessional work culture.”

actual layoff, or termination of services. More people have begun losing jobs lately, as recorded by CMIE. Though the fall is not as steep as it was in April 2020, the dip is getting steeper. It could get worse in the coming months.

Job losses will mean more distress, more personal loan defaults, and possibly more borrowing against gold. Brace yourselves for even more turbulent times, no matter what the government tells you.

Forebodings about the coming crisis are echoed even by D Subbarao, former RBI Governor. Speaking to PTI, he expressed concerns over the "extreme unevenness" in economic recovery and "sharpening inequalities" between upper income segments and lower income households in the country, cautioning that the trend will hit growth prospects going forward. He also termed this uneven recovery "morally wrong and politically corrosive,"

Instead of strengthening the economic foundations of India, he lamented that the current liquidity in the domestic market and foreign fund inflows are leading to soaring of prices of stocks and other assets despite disruptions due to Covid pandemic.

In fact, it is bizarre that the stockmarkets should be racing ahead despite these portents. Most investment fund managers keep explaining that the rise in the market indices reflect a glowing future. It is at such times, that a humorous quip doing the WhatsApp rounds makes more sense that all the theories put forth by market pundits (see pix)

Extreme unevenness

And this brings one to another pain point for India. At the heart of the crisis are precisely the two fears that Subbarao highlights. One relates to the unwillingness on the part of the policymakers to address the "extreme unevenness" in economic recovery and "sharpening inequalities,"

Nothing expresses this better than a comparison on the income group structures in India during pre-pandemic times and post-pandemic times. Look at the way government policies allowed the middle class to shrink by at least 67 million, and the number of poor expand by 75 million.

Compare these numbers with what has happened to the wealthier classes. High income groups saw a decline of just 1 million (compared with a decline of 3 million in China). Upper income middle classes saw a decline of just 7 million in India compared to a decline of 18 million in China.

But when it came to lower income groups, India fared far worse than China. In fact, while the low-income-middle-class saw numbers increase by 30 million in China, India saw a decline of 35 million. And when it came to poverty-stricken people, China saw an increase of 1 million poor people while India saw this number swell by 75 million. China’s primary concern was keeping people away from poverty. India seems to have been concerned with protecting the affluent. Thus, while the world was focussed on reducing poverty, India achieved the opposite.

Look at the way bank frauds continue. Consider the haircuts given to loan defaulters (haircuts have been as high as 90% in some cases). Assets being transferred to their new owners at ridiculous prices is one thing, but allowing promoters to retain assets which were acquired out of ill-gotten gains is extremely worrisome. Consider some of the recent instances:

The Essar deals

The Sandesara brothers who remain at large despite defrauding banks

The Ruchi Soya-Patanjali deal with banks.

The C Sivasankaran-IDBI deal which has encouraged other defaulters to work out similar deals

the Vedanta-Videocon deal

And the list goes on. The ultimate loss is borne by taxpayers, whose money is used to recapitalise banks, and yet leaving the original promoters laughing all the way back home. Thus, promoters got richer while taxpayers became poorer. The unevenness sharpened.

Focus on rural purchasing power

As mentioned earlier, the first priority for the government must be increasing purchasing power. The best way to do this is to invoke minimum price protection for milk and vegetable farmers across India. The three farm legislations that the government has been waxing eloquent about does nothing for these segments. Milk is three times larger than rice and wheat together. Yet it has been ignored.

Begin with Uttar Pradesh, where the numbers are the largest, and poverty most acute.

Simultaneously, ease the conditionalities for investments. Stop distracting people with attacks on protestors and media groups. Focus on economic growth.

Start with giving farmers the guarantee of minimum prices – not just for farmers of rice, wheat and maybe pulses. Give minimum prices to milk farmers of Uttar Pradesh – the country’s largest producer. That will give farmers purchasing power, without being reduced to the status of beggars seeking grants and doles. Do the same to farmers of oil seeds and even vegetables. Please remember that 65% of the population stays in rural areas.

Count the dead

Second, immediately start giving grants to families of people who have died. Make public those lists so that nobody is left out – be they with or without Aadhar cards. This must be applied uniformly across the country, irrespective of states which are governed by opposition parties.

This will have three major benefits.

many of the families who are in distress got there because they had to pay for medication and even funeral rites. It won’t be surprising if these are the ones who have pledged their family gold to pay for the life of a loved one. It is only fair that the government funds them for the losses they have already faced. If a family has lost two members, give them double the grant. And to prevent bureaucratic quibbling, let the grant be given to the family of each dead person who has died since February 2020, irrespective of the cause of death. The Supreme Court has suggested a payment of Rs.4 lakh be made per death. The government says it does not have the money. But when compared against the Rs.4.6 lakh crore lost by which government banks between March 2013 till June 2020, the money for the families who have lost a loved one should be significantly less. Do it. You owe it to your citizens.

in order to do this, the government must produce lists of people who have died, giving India a better idea, about how many people have actually died. Currently, if the reports of an NGO in Tamil Nadu are taken into account, the number of people dying could be as high as 9 time more than the deaths reported. And do note that Tamil Nadu has a better administrative setup than states like Bihar and Uttar Pradesh. It is possible that the actual numbers of deaths could be staggeringly higher. In Bihar, the courts had to order the government to disclose the figures.

Even The Economist states this quite categorically in its 12 June 2021 issue: “News organisations . . . have speculated that India has suffered perhaps five to seven times more “excess deaths” than the official number of covid19 fatalities, currently just over 355,000.” That could put the number of deaths at over 2.4 million!

once the dead have been identified, their names should be struck off the rolls of election registers, to prevent someone from casting votes in their names. With bogus Aadhaar cards already floating around this reduces the cancer of benami voting. The Election Commission has maintained silence on this issue. This is discomforting because Uttar Pradesh elections are round the corner.

Support urgently needed

T V Narendran |

The strongest appeal has come in from T V Narendran, President, Confederation of Indian Industry (CII): “There is fiscal headroom of up to Rs. 3 lakh crore and this amount can be channelised towards direct cash transfers to the vulnerable people, higher allocation for MNREGA, short-term GST rate cuts and lower excise duty on fuel.”

Demand can also be revitalized through a time bound tax concession of interest rate subvention for home buyers, a LTC cash voucher scheme as done last year and extending the Atmanirbhar Bharat Rozgar Yojana till 31 March 2022,

All this will be in addition to the things this author has spoken of in his series which outline an agenda that the government must follow if India has to be revived.

To conclude, India is bleeding. It needs to be revived. And it won’t be easy. The first step will be ensuring farmers get the right price for their produce. Milk ought to be the priority because the largest number of farmers are engaged in animal husbandry. Crops other than rice and wheat should be the second priority. Simultaneously, MSMEs need to be bailed out. Unless there is purchasing power, there will be no vibrant India. No acche din ahead.

The author is consulting editor with FPJ