Note from the author: This article has two parts to it. This part looks at investments China has already made in India. The second part will examine ways in which both India and China could benefit tremendously even more from such investments.

Chinese FDI into India is small – at $6.2 billion. This is minuscule compared to investments by countries like Germany, USA, Japan and others. Moreover, many investments – like those by Sweden and Germany – date back to pre-independence days. At today’s prices, they would be extremely large.

However, although China’s investments are not large, their impact on India has indeed been massive. Thanks to the penetration of technology, the product quality, its pricing, and above all its marketing, China’s footprint in India is much larger than the size of its investments would indicate.

That is also because China has made investments in technology, while many other countries have focussed on the conventional manufacturing sector. This has been rightly pointed out by Gateway House in its 10 February 2020 report titled Chinese investments in India .

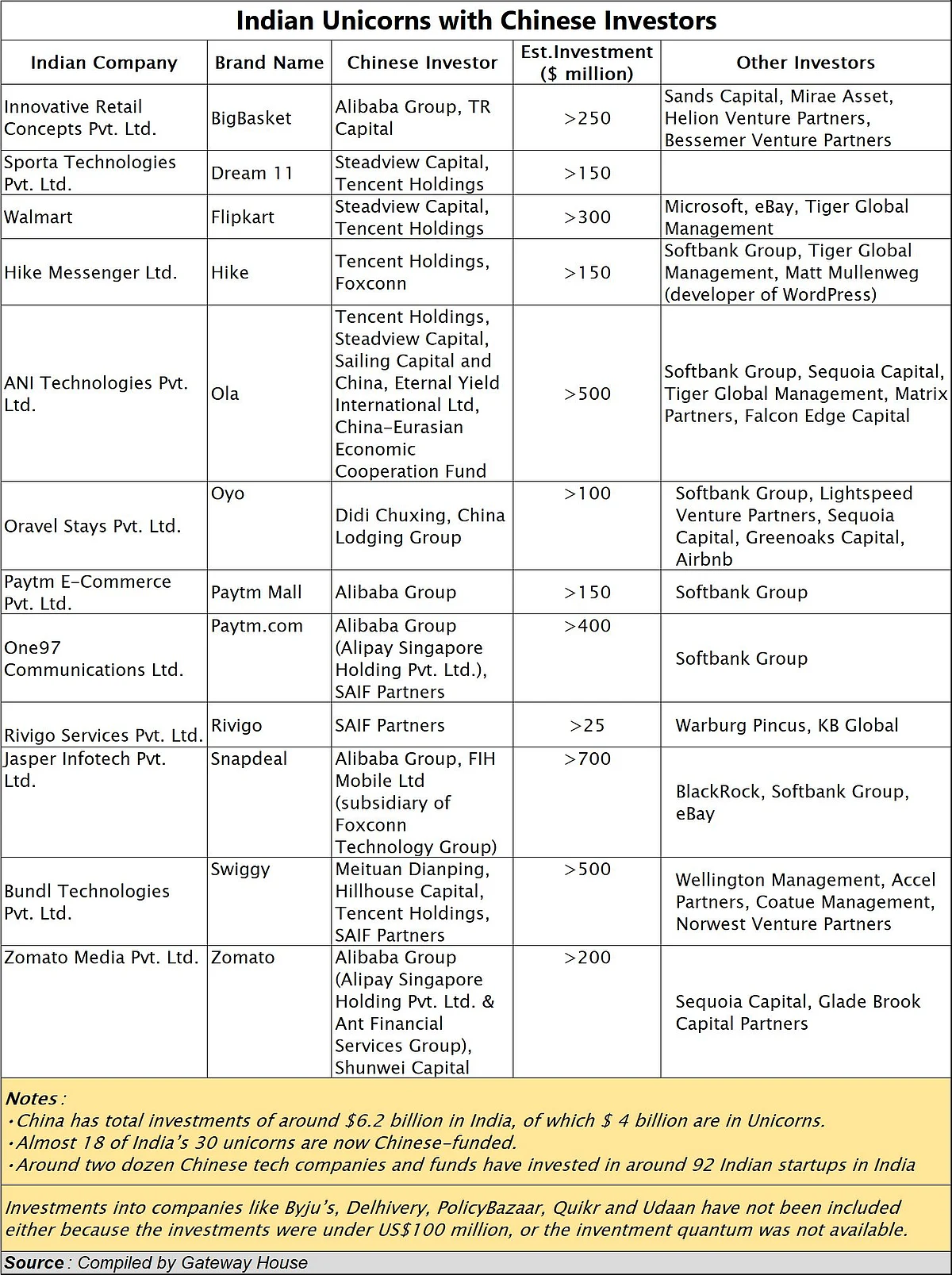

As a result, despite accounting for just around $4 billion in Indian start-ups, China accounts for investments in as many as 18 of India’s 30 unicorns. Some of them are listed in the table alongside. Globally too, the Chinese BAT (Baidu, Alibaba and Tencent) is often viewed as a formidable challenger to the Western FAANG (Facebook, Amazon, Apple, Netflix, Google).

TikTok for instance has 200 million subscribers and has overtaken YouTube in India. “Alibaba, Tencent and ByteDance rival the US penetration of Facebook, Amazon and Google in India. Chinese smartphones like Oppo and Xiaomi lead the Indian market with an estimated 72% share, leaving Samsung and Apple behind”, adds the Gateway report.

And, mind you, the list does not include the likes of Huawei, which employs over 5,000 software engineers in India and could become the most formidable telecom company in the world. Investments made by Huawei in India are not known. Then there are investments in banking (ICBC and Bank of China), heavy engineering (Sany), consumer products and power (both solar and conventional) generation. China is also a major consultant to India’s investments in metro railways. China has not invested in India’s ports and airways because of security concerns raised by Indian authorities.

Expect China to play a major role in India’s mobility solutions on account of its immense prowess in producing electric vehicles. Says Gateway, “So far, Chinese automakers have invested $575 million in India. The competition in India is fierce, and it’s with Indian and Asian automakers like Suzuki, Hyundai and Toyota, even as US automakers withdraw.”

Similarly, expect the Chinese to play a big role in India’s pharma sector. Gateway too points out that the “single largest Chinese investment in India is the $1.1 billion acquisition of Gland Pharma by Fosun in 2018. This accounts for 17.7% of all Chinese FDI into India.”

But the tech sector is extremely important, and there are three reasons for this:

- There are no major Indian venture investors for Indian start-ups. China has exploited this opportunity. Alibaba made an investment in 40% of PayTM in 2015. Demonetisation helped it grow faster. Today it is the biggest player in this segment.

- China provides the patient capital required. The trade-off for market share is worthwhile. You lose some. But gains are big time. Most other players are impatient with their investments.

- The huge Indian market has both retail and strategic value for China. Its timelines are therefore longer and constantly changing compared to those of funds like Sequoia and SoftBank, which offer venture capital from the West.

Yet, government data, does not view China as a major investor. That is because China makes its investments through myriad ways. In fact, just two dozen Chinese tech companies and funds have invested in around 92 Indian start-ups in India.

As Gateway explains, “All this adds up to just 1.5% of the total official Chinese (including Hong Kong) FDI into India. This doesn’t cover investments made by funds based out of Singapore and elsewhere, where the ultimate owner is Chinese, so the actual investment in India will be higher.”

Moreover, most of the investments in other countries are for building bridges, railways and roads, not in technology. It is possible that the benefits to China from this 1.5% share could be several times larger than all the investments put together. (Part II – next week)

The writer is consulting editor with FPJ.